I Internet merchants in the world: Looking at online shopping consumption outside Taobao from Alipay data (1)

Text/World Network Business Data Analyst Sun Jixia

Without consumers, transactions cannot be established. For businesses, data about consumers is very important. At one time, obtaining a consumer report required a long and thorough investigation. With the continuous development of e-commerce and the increasing magnitude of data, various data products serving businesses came into being, and the way to obtain consumer data became more convenient and the cost was lower.

Among them, Alipay data is the largest gold mine in all data. First of all, Alipay data is based on real consumption data, or data generated from each real transaction, which is more reliable than other consumer research data; Secondly, Alipay data not only includes Taobao, but also has a broader user base, which can be said to include all aspects of e-commerce in all fields, and its rich data is unparalleled by any other company.

Therefore, "Tianxia Online Merchant Manager" and Tianxia Online Merchant Data Center jointly launched Alipay Data Compass, starting with the data of merchants outside Taobao, and brought a real online shopping data report of consumers outside Taobao for readers.

In particular, these data samples come from e-commerce websites supported by Alipay in 2012, except Taobao, which has extremely high reference value.

Demographic characteristics of online shopping consumers

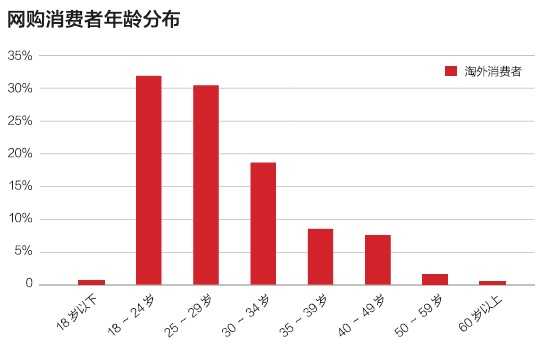

1. Age distribution of online shopping consumers: Young people are the main force of online shopping.

Amoy e-commerce website accounts for more than 60% of online shopping consumers under the age of 30, and about 10% of online shopping consumers over the age of 40. It can be seen that online shopping consumers are generally young at present.

2. Geographical distribution of online shopping consumers: Online shopping is popular in third-and fourth-tier cities.

At present, consumers of e-commerce websites are mainly distributed in first-and second-tier cities, accounting for 67.9%. According to Alipay’s annual statement, in 2012, the number of online payment users in fourth-tier cities increased by 64%, and the amount of online payment increased by 68%, both exceeding those in first-and second-tier cities. Online shopping has gradually spread from developed areas to less developed areas, and the development speed of small cities can not be underestimated.

The province with the largest number of consumers on e-commerce websites is Guangdong, and Shanghai, Jiangsu, Zhejiang and Beijing also enter the top five. According to CNNIC data, the absolute number of Internet users in Shanghai ranked 13th in China in 2012. Based on Alipay data, it can be seen that the online shopping penetration rate in Shanghai is very high. The distribution of online shopping consumers in the top five provinces accounts for more than 50%, and the top ten provinces account for about 70%, which shows that the regional concentration of online shopping consumers is high.

Behavioral characteristics of online shopping consumers

1. Distribution of shopping network age: More than 40% of consumers have been shopping online for less than 2 years.

More than 40% of consumers on the website of Amoy E-commerce are online shopping for less than 2 years, among which the proportion of new consumers in 2012, that is, the proportion of consumers with online shopping for less than 1 year reached 23.4%, with more new consumers.

2. Frequency of purchase: Most consumers only shop online once a month.

70% of e-commerce website consumers only shop online once a month, and the proportion of consumers who shop online more than three times a month is less than 15%. For e-commerce, increasing the online shopping activity of consumers is an important issue.

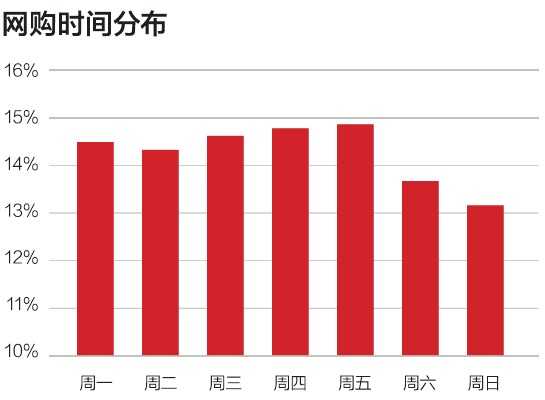

3. Time distribution of online shopping: Consumers are more enthusiastic about online shopping on weekdays.

Consumers are more enthusiastic about online shopping on weekdays, and the number of online shopping consumers on weekends is significantly reduced. Because consumers can arrange their own time more freely on weekends or holidays, the shopping scene may shift to offline, while on weekdays, consumers do not have a lot of time to go out shopping, so they are more inclined to choose convenient and fast online shopping.

The online shopping time of consumers is consistent with the work schedule, and the shopping time is mainly concentrated in the daytime working hours and the evening at home. Among them, the shopping enthusiasm during the daytime working hours will be higher than that after work at home at night, and the shopping enthusiasm will drop slightly during commuting and eating time. Merchants can adjust their tactics according to the time distribution of online shopping to better meet the online shopping needs of consumers.

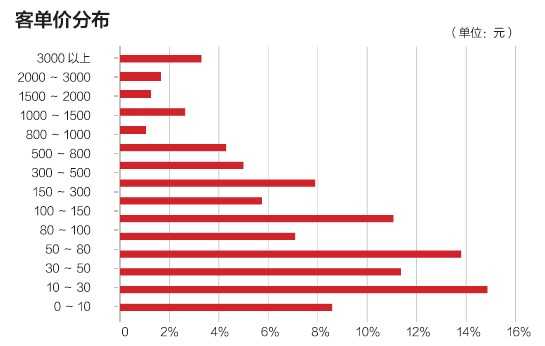

4. Customer unit price distribution: More than 70% of consumers’ online shopping customers have a unit price below 200 yuan.

The proportion of consumers whose unit price of e-commerce websites is above 1000 yuan is 9%, but more than 70% of consumers’ unit price of online shopping is below 200 yuan. It can be seen that most consumers tend to buy cheap items in online shopping at present.

5. Shopping preference: Clothing and accessories are everyone’s favorites.

Regardless of men and women, the top two categories that consumers love to buy are clothing and accessories. Household items are the third favorite category for women and the fifth for men, which shows that women love to buy household items more than men. 3C digital products are the fifth favorite category for women and the fourth for men, which shows that men love to buy digital products more than women.

The top two shopping preferences of all ages are clothing and accessories, but the top five shopping preferences will change with the growth of consumers’ age. For example, household items are the fifth category that consumers under the age of 24 prefer to buy, and from the age of 25, household items have risen to the third place; For consumers aged 30-39, maternal and child products have entered the top five, which reflects that most people in online shopping choose to marry late and have children late. Consumers aged 40-49 pay more attention to sports categories, and sports enter the top five shopping preferences in this age group. Consumers over the age of 60 are keen to buy food online, and food ranks among the top five in their shopping preferences. Online food provides convenience for the elderly who are not convenient for young people to move.

via: i.wshang.com