Quotations Detective | From whom did Qian Gurong’s "Literature is Human Studies" originate?

In March 1957, East China Normal University will hold a large-scale academic seminar. At the request of the organizer of the conference, Qian Gurong, then a lecturer in the Chinese Department of East China Normal University, wrote the article "On Literature as Human Studies" the month before. In May of that year, this paper was published in Literature and Art Monthly (predecessor of Shanghai Literature).

On "Literature is Humanism" begins with a clear meaning-Gorky once suggested that literature should be called "Humanism". Later, Qian Gurong explained this: "We often quote Gorky’s opinion when explaining that literature must be described by people and create vivid typical images. But our understanding stops here, only knowing that we can’t take a step forward because we are stuck in emphasizing the importance of writing people. In fact, the meaning of this sentence is extremely profound. We can simply regard it as a master key to understand all literary problems. Whoever wants to go deep into the literature and art hall, whether he is a creator or a theorist, must master this key. Without this key, theorists cannot explain a series of phenomena in literature and art; If the creator forgets this key, he can’t write exciting real works of art. "

To be honest, "literature is human science" is the key to understand all literary problems. As a unique language art of human beings, how can literature settle down without "people"? This is common sense. But just because it is common sense, people tend to be ignorant of it and don’t ask for a very good solution. For example, as a proposition that anchors China’s values of modern and contemporary literature, whose mouth did "literature is a study of human" originally come from? For a long time, the academic community has been unable to agree. Even Qian Gurong, who used this key to open the door to China’s modern and contemporary literature, has experienced repeated explorations. Today, the answer he gave himself may not be convincing.

Collected Works of Qian Gurong

Qian Gurong’s initial answer was Gorky. The full text of On Literature as Human Studies is more than 30,000 words, and Gorky’s name is mentioned 33 times. The gesture of "I note the Six Classics" is self-evident. However, after reading this article, you will find that the actual effect is "six classics note me". Interestingly, as far as the view of humanitarian literature expressed by Qian Gurong is concerned, Gorky’s literary theory, which is the "Six Classics" that he quoted, that is, the "proletarian artistic authority" (Leninist), is not solid and powerful in supporting the thesis. Gorky’s theory is not completely compatible with Qian Gurong’s point of view in some specific discussion links, such as the task of literature, the motivation of literary creation, the abstraction or concreteness of people in literature, and especially the typical creative mode of literature. On the contrary, in the same article, Chernyshevski, another Russian writer cited by Qian Gurong, is in the same breath as the author.

As a matter of fact, searching for the whole paper on "Literature is a study of humanity" does not show the words "Literature is a study of humanity" or the sentences such as "Literature is a study of humanity" in the form of Gorky’s direct quotation. Looking up Gorky’s related writings and speeches, I found no such expression.

In this case, why did Qian Gurong associate "literature is human studies" with Gorky? Obviously, he equated Gorky’s suggestion that "literature is called’ humanism’" with "literature is humanism". And where does "calling literature’ human studies’" come from? Qian Gurong said: "It comes from Timofeev’s Principles of Literature." In 1953, the Principles of Literature, published by Pingming Publishing House, was mentioned in many places, and Gorky called literature a "human study". However, in this edition of Principles of Literature, Timofeyev did not annotate the origin of Gorky. It was not until 1959, that is, two years after "On Literature as Human Studies" was written, that Timofeyev indicated in the revised edition of "Principles of Literature" that Gorky’s statement came from the article "On Skills". In 1979, People’s Literature Publishing House published this article. According to this version, Gorky’s original words are not "calling literature" human studies ",but" literature is the best literature of "people’s studies" or "human studies".

It is necessary to point out that, from Gorky’s original words to Qian Gurong’s quotations, the semantics have changed a long time ago after being reported by many texts and translated in different languages. But one thing is certain, Gorky is not the original creator of "literature is human studies".

Because of this, since the publication of "On Literature as Humanism", the controversy about the real origin of "Literature as Humanism" has never stopped. As a party to the debate, Qian Gurong’s attitude has also gone through the process from "defense-persistence" to "doubt-correction" and even self-denial. Finally, he admitted that "Gorky may not have said that literature is a human study".

Of course, denying Gorky, Qian Gurong didn’t give up solving the mystery he created. He found a new answer: Dana.

How did Qian Gurong find Dana? There are related descriptions in his correspondence and interviews in his later years:

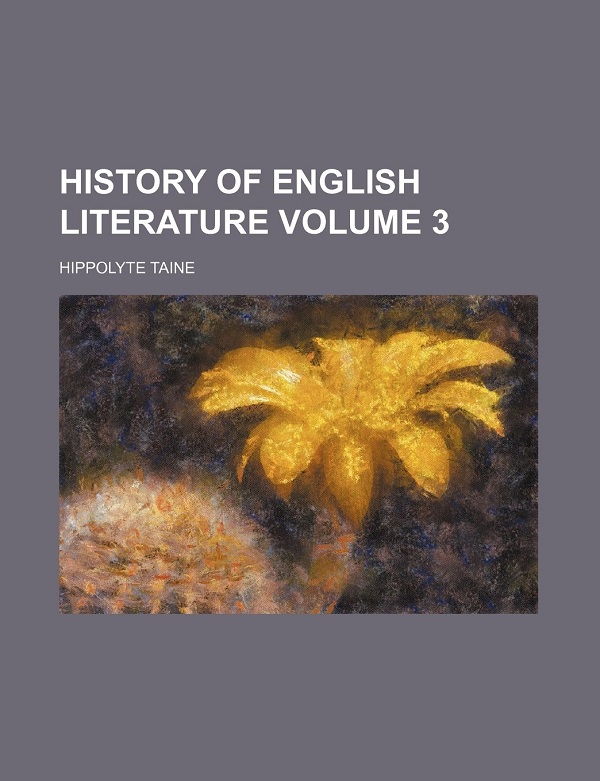

In July 2003, Qian Gurong said in a letter to literary critic Li Ling: "I remember that one day in the 1990s, I happened to read the English version of A History of English Literature written by Tanner. In the preface of the book, Tanner said in plain language:’ literature, it is the study of man’. Turner was born in 1828, 40 years earlier than Gorky. The invention right of the phrase’ literature is human studies’ should not belong to Gorky, but to Turner. "

In March, 2005, Li Shitao, a classmate from Qian Gurong, mentioned this matter again, and the expression was basically the same, adding that Dana’s History of English Literature was kept in his family.

In June 2014, Qian Gurong repeated the above words in an exclusive interview with Ma Xinfang, a reporter from Shenzhen Special Zone Daily, only emphasizing that "the book History of English Literature has always been in my family, but I didn’t read it".

Qian Gurong’s book-flipping in the 1990s was a rock-breaking event. The three key clues he came across while turning pages —— Dana, the preface of English History of English literature, and "literature, it is the study of man" —— refreshed people’s understanding of the origin of "literature is the study of man".

Danner, a famous French philosopher, historian and literary theorist, had a far-reaching influence on literary research in the 19th century. In China, Dana’s most famous literary theory work is Philosophy of Art, which was translated by Fu Lei.

The History of English Literature, written by Dana from 1864 to 1869, has no complete translation in China, and some chapters are scattered in books compiled by others. For example, the second volume of Selected Western Literary Theories edited by Wu Yifu contains the second chapter of the preface to the History of English Literature; The Interpretation of Shakespeare’s Plays compiled by Zhang Ke and Wang Yuanhua contains the "Shakespeare Theory" in the History of English Literature.

"literature, it is the study of man", according to Qian Gurong, comes from the preface of the English version of The History of English Literature. Literally, it can indeed correspond to the Chinese saying that "literature is human studies".

If we deduce from these three evidences, the invention right of "literature is human studies" will undoubtedly belong to Dana. Never thought, a new round of questioning appeared soon, and it was rigorous and powerful. In the first issue of China Social Sciences in 2010, Liu Weiqin, a professor at South-Central University for Nationalities, published a paper "Reflections on the Proposition that Literature is a Human Study", which revealed a surprising fact-the original version of Dana’s History of English Literature was in French, while Qian Gurong read the English version. The popular English version of The History of English Literature was translated by Henri Van Laun. However, Liu repeatedly read the preface of this translation, but failed to find the words "literature, it is the study of man". Liu then consulted the preface of the original French version of The History of English Literature, and failed to find a French sentence corresponding to "literature is human studies". Even the sentence closest to "literature is human" is far from its precise meaning.

What is the problem? Let’s take a closer look at Dana and his writings.

The English Version of Dana’s History of English Literature

In the history of western literary theory, Danner was deeply influenced by Comte’s positivism and Darwin’s evolution theory, and borrowed natural laws to explain literary phenomena earlier. The representative work of Dana’s literary theory is the preface to the History of English Literature. In this article, Dana systematically expounded his famous theory of "three elements" of literary development, and he advocated that literary creation is determined by three forces: race, environment and times, which constitute the "internal root", "external pressure" and "acquired momentum" of literary development. The History of English Literature takes English literature as an example to prove the theory of "three elements".

It is true that the preface of the History of English Literature can be regarded as an article on literary theory, but it should be classified into the categories of cultural anthropology and historical sociology. Because Dana pays more attention to the general mental state and national temperament that produce literary works, the writer’s psychology and character as an individual are often ignored by him. As Dana’s teacher St. Pevey commented: Mr. Dana’s research method did not touch the unique and specific individuals, and he always stayed outside, letting the so-called talents and talents escape from the mesh.

Furthermore, Dana’s research paradigm of literary theory, which pays attention to the whole nationality, runs counter to the description of "concrete, living people" in literary works advocated by Qian Gurong in On Literature as Human Studies.

Therefore, it is understandable that Qian Gurong’s new answer-Dana, which was sought by the original creator of "literature is human studies", was questioned.

A good guess, perhaps, Qian Gurong turned to another English version of the History of English Literature in the 1990s; Perhaps, in that version, the English translator has drawn up a title and added a new note for the preface of the book, and "literature, it is the study of man" is part of the title or note …

Perhaps, it’s just that Qian Gurong’s memory is biased. However, with the death of the old gentleman, these have become unsolved mysteries.

Perhaps, we should make a bolder guess: before the publication of On Literature as Human Studies, no one explicitly said that literature is human studies. As one of the most important propositions in modern and contemporary China literature, "Literature is the study of human beings" was invented by the discoverer Qian Gurong himself. Truth is largely a matter of courage. Qian Gurong found a key to understand literary problems with great theoretical courage, but his humility made him devote his time and energy to a fruitless task-to find the person who made the key.

?

?