The ambition of byte music, the dilemma of left and right fighting each other

Wen | Deep pupil business, author | Chu Qingzhou, post | Deep pupil business

Is the future of online music as optimistic as some people in the industry expected? I’m afraid there’s a question mark.

On March 22nd, Tencent Music announced its 2021Q4 and full-year financial report. Online music MAU decreased by 1% year-on-year, social entertainment MAU decreased by 21.5% year-on-year, and its net profit in 2021 decreased by 27% year-on-year. In the fourth quarter of 2021, net profit decreased by 55% year-on-year.

In this context, the total revenue has further increased, and the performance highlight of paying users increasing by 20 million year-on-year is not enough. However, Tencent Music is the leading streaming music group in the world.

Last April, Tencent Music changed coaches. I had expected some better changes in this company. But today, it has been nearly a year since Liang Zhu took over as CEO, and the situation facing the company is still hard to say optimistic.

Tencent Music’s conference call further pointed out that the total revenue in the first quarter is expected to drop by about 15-17%, mainly based on the macro and competitive challenges faced by live broadcast.

In the competition, how short videos impact the online music market has become an unavoidable problem in discussing the development of the industry.

Therefore, when ByteDance focused on the online music track, it brought an indescribable excitement to the whole market.

On the bright side, after the exclusive copyright of online music was banned last year, copyright oauth2.0 is a general trend, which seems to be a great benefit to new players. At the same time, in recent years, under the devastating baptism of short videos to music culture, the old rules seem to have been broken.

It is in this context that ByteDance first upgraded its music business to P1-level priority business, launched the Galaxy Ark music distribution business, and upgraded its musicians to serve as a hot Galaxy platform. Recently; Also officially launched the music APP "Soda Music".

The online music market, which has been silent for a long time, has great expectations from spoiling the game to entering the game.

Can soda music bring great changes to music streaming media?

At present, the discussion of this issue in the industry media focuses more on the "product innovation" of soda music.

But what does online music business mean for ByteDance? Where is the real breaking point of byte music?

In the view of Shentong Business, the "product model innovation" of soda music may not be the future of ByteDance. How to develop a new "business model" is the key to byte music and even the whole industry.

As a matter of fact, the differences in product models that provide streaming music services are not enough to become competitive, and the competitiveness lies in the differences in content.Because of the great differences in personal music tastes and creations, there is no standardized solution.

As far as the current situation of the industry is concerned, the copyright content will become the core problem that restricts the development of soda music for positioning streaming media services. This paper mainly analyzes the practical problems in the development of ByteDance’s music business:

1. Can ByteDance pay the copyright owner a satisfactory consideration?

2. The exorbitant copyright transaction price in the current market is beyond the digestion (rather than affordability) of byte music business;

3. The music business cannot provide cash flow support for bytes in a short time.

The July 24 penalty order has brought some hope to the industry, but the situation is not optimistic enough.— —Even in the so-called "post-exclusive copyright era", the core problem of high copyright cost is still difficult to break through.

On the one hand, according to the industry news learned by Shentong Business,Many "all-round and open copyright negotiations" are stuck in the issue of "price", which is related to the existing interests of copyright owners and is difficult to promote.

On the other hand, international music copyright investment mergers and acquisitions are frequent, which may further raise the global music copyright price in the later period.In the first four months of 2021, the global music acquisition and music library investment reached $7 billion, and the price of popular songs increased by 20-35 times, with Indian and China markets as the focus.

It is worth noting that many transactions and authorizations of head copyright are split transactions, which will further increase the difficulty of "collecting stamps" copyright on streaming media platforms. Bob Dylan’s copyright transactions with a total price of about 500 million US dollars are distributed in Universal and Sony.

In the abnormal copyright business, big record companies have too many negotiating advantages.

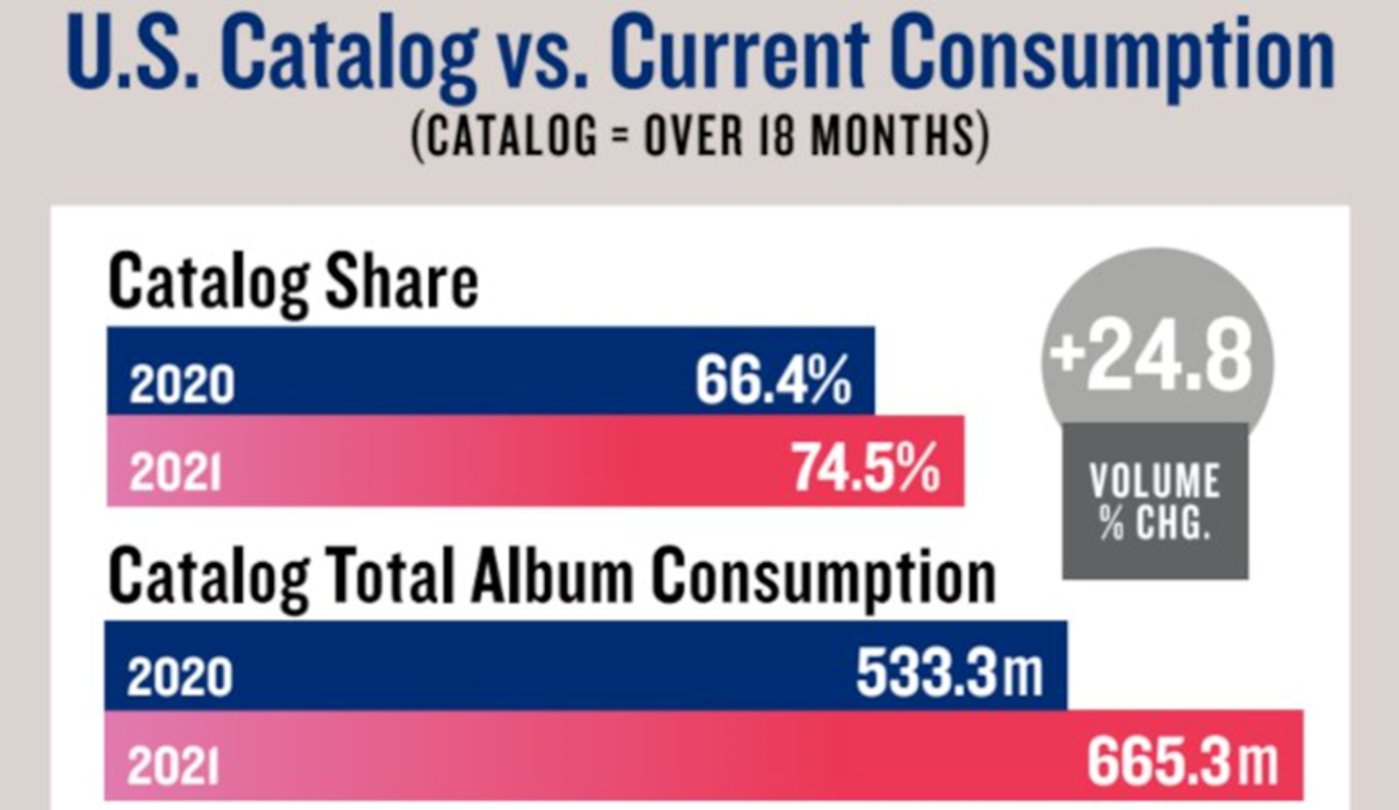

According to the MRC report, in 2021, the proportion of recorded music released for more than 18 months on the American music streaming platform further increased from 66.4% in 2020 to 74.5%, and nearly three-quarters of it means — —

Without copyright, there would be no online music service, which is a heavy reality that ByteDance can’t avoid.

On the other hand, the proportion of "music copyright in stock" has been greatly increased, and the streaming media broadcast volume of new songs is declining.Online music services have gained more older users, and young users have also shown their preference for old songs, which will provide a basis for the copyright value of "old songs".

On the other hand, the proportion of "music copyright in stock" has been greatly increased, and the streaming media broadcast volume of new songs is declining.Online music services have gained more older users, and young users have also shown their preference for old songs, which will provide a basis for the copyright value of "old songs".

In a short period of time, the streaming music platform is rightThe dependence on "stock music copyright" will still drag down the normal development of the whole industry.— — ByteDance, a newcomer, needs to face this problem sooner or later.

Last September, Late reported that since June 2021, Byte has invested no less than 1 billion yuan in music copyright. On the other hand, the strategy focuses on purchasing original songs and signing long-term cooperation with online celebrity Talent.

But frankly speaking, 1 billion yuan is sufficient for the logic of byte purchase at that time, but it can only be said that it is a drop in the bucket for streaming media services.

Needless to say, in the era of exclusive copyright, the content of a single head record company soared to the transaction price of 100 million; In contrast, in October last year, Blackstone injected $1 billion into the new Hipgnosis Fund for the acquisition of music rights.

For Byte, the biggest problem is not how much money it can pay, but whether the cost of its copyright expenditure can be digested in its business development.

Theoretically, after the July 24 penalty order, the "copyright mountain" of the music industry has changed from a market subject to the copyright market price itself. It is more realistic for copyright transactions to return to the long market negotiation and adjustment. On the market level, the current demand of domestic online music platforms for copyright owners to reduce prices is a trend deviation from the background of rising global music copyright costs — — The expectation of falling music copyright price is still not optimistic in the short term.

At present, ByteDance has copyright cooperation with the three major record companies in the world, but its use scope is still limited to short videos and related extension services. For ByteDance, it is not the right time to trade the copyright of full-length head music.

Let musicians stay in the Tik Tok system and let more mature musicians enter Tik Tok — — Perhaps it is the most appropriate goal for the development of byte music business at present.

In recent years, the general mode of ByteDance’s new business is basically: first, as a traffic platform to undertake related advertising business, games, online education, e-commerce, and then directly enter the market at a suitable time.

In the era of online video, music has always been the hottest field. Nowadays, more and more songs have become popular in Tik Tok, and the effectiveness of short videos in music communication has long been valued by streaming media platforms. Tencent Music and Netease Cloud Music are all trying to make efforts in the innovation and support of short video products.

This means that,Musicians not only flow between music platforms, but also flow between short videos and music platforms.For music creators who became popular through Tik Tok and bilibili,The natural innovation and short popularity of short videos are the inherent limitations that restrict their development to more professional musicians.

When the industrialized and more complete music platform invites short video musicians, the loss will inevitably occur on the short video platform.

In fact, short video has become an important link in the modern music industry, such as the distribution service of Galaxy Ark, which is still a business closely linked with traditional streaming media. The Red Star River is nothing more than a musician’s version of the "Creator Support Program".

In addition, another key point is that, unlike the previous games, online education and e-commerce businesses,Online music business is not a business that can bring cash flow in a short time, which will affect Byte’s determination to invest in music to some extent.

Expect the majority of C-end users to recharge their music experience, and look at ARPPU, where two domestic music giants are wandering below 10 yuan, and you will know that there is still a long way to go.

Even in the film and television industry, which is highly dependent on incremental content, the high content cost is still difficult to be solved by self-control. For the music market based on "inventory copyright", the inequality of copyright transactions is almost a fateful problem.

In the early years, the expansion of Tencent Music was based on the game of burning money, but in today’s Internet environment, whether for the music industry or ByteDance,Commercialization will be the top priority from the beginning.

For the massive traffic resources of bytes, the in-depth exploration of music business will gain more realistic benefits for byte music from streaming media platforms, copyright parties and advertisers. This means that in a short time, byte music will still be highly dependent on the Tik Tok system.

To put it simply, from the perspective of monetization, the return rate of games and e-commerce is higher, and within the limited traffic distribution, the resources that Tik Tok system can give to music business are insufficient. However, the failure to "de-Tik Tok" will also restrict the further independent development of its music business.

Compared with the original music business, the biggest change of soda music is not the innovation of product model, but the exploration of paid business model based on copyright content..

At present, soda music has been launched on the paid membership system and digital album sales, and the membership price is low.

In today’s huge byte business system, payment has always been a very lacking business model. Wukong question and answer, online education, etc. had the opportunity to go further in the payment model, but they have all been defeated; The byte game business, with reference to the development of Ali Linxi Entertainment, still needs breakthroughs in research and development and opportunities.

However, the paid service of online music is really a choice with long payback period; Coupled with the purchase restriction of digital albums since last year, at present,The online music business income of the whole industry still only has the significance of equalizing the cost level.

According to the conference call of Tencent Music Financial Report, it is expected that the online music business will break even at the operational level in 2022. This is enough to show the difficulty of making profits in online music business.

The music industry is largely driven by streaming media, but direct sales to fans are the largest share of most artists’ income.Does the online music platform exploit musicians?

Maybe not.

The first financial report disclosed by Universal Music Group at the beginning of the month showed that in fiscal year 2021, the company’s revenue was 8.504 billion euros, an increase of 14.4% compared with 2020, and an increase of 17.0% at a fixed exchange rate. Operating profit reached 1.399 billion euros, a year-on-year increase of 15.4%.

Subscription and streaming media revenue are still the main sources of performance of copyright giants such as Universal, and are increasing year by year.

On a global scale, the contradiction between musicians and online music platforms is still fermenting, and more and more musicians try to bypass the music platform to release their works. In 2021, independent musicians earned $9.9 million on the musician website Bandzoogle.

For ByteDance, who is at the forefront of the global social media wave, it is indeed the most appropriate way to combine the advantages of its creator ecology with the wave of independent music.

In the process of ByteDance’s rapid growth to a new level of Internet in China, the "traffic advertising model" is almost the only pillar of its commercialization. In essence, ByteDance is still an "advertising behemoth". In recent years, the expansion of Byte to e-commerce, games and even corporate services all shows anxiety before the peak of traffic.

The diversification of business models often points not only to the growth of business space, but also to the only way for enterprises to feel safe.

The product model of soda music, to some extent, shows that Byte is not determined enough to develop the music business, but this may not be a bad thing.

If you know enough about the online music business, you will know that the situation of a renewed war is unlikely to happen. The industry will still slide on the old road for a long time before the long-standing disadvantages are broken.

Byte music is busy fighting left and right. Don’t expect too much for the time being.