[car home Information] "In the future, our place will be the delivery and after-sales center of HarmonyOS Zhixing in Beijing, and all cars that place orders will come here to pick up their cars. We will include’ four worlds’, besides’ asking world’ and’ intellectual world’, there are also’ two worlds’, that is, the products of our intelligent car selection business partners, including Cyrus, Chery, Jianghuai and BAIC." The sales of an AITO authorized user center store in Beijing told the anonymous author.

Just a few days ago, HarmonyOS Zhixing went online in official website, where Celeste, Chery and Huawei cooperated with each other in depth, and Zhijie S7 appeared on the page, and the Zhijie S7 with a starting price of 249,800 yuan was attractive enough. However, we also noticed that the previous customers M5 and M7 didn’t board official website, so this car will be different from the customers M5 and M7. For this reason, the author also visited HarmonyOS Zhixing Store for the first time and experienced the real car of Zhijie S7.

"The price and rights of Zhijie S7, the difference between the four models is mainly in the battery life and the number of motors, and some configurations are different."

An AITO authorized user center store in Beijing will become a HarmonyOS Zhixing store.

"HarmonyOS Zhixing official website only showed the asking world M9 and the intellectual world S7".

● How deep is Huawei’s participation in HarmonyOS Zhixing’s "first car"?

I don’t know what you think of the word "far ahead". When Yu Chengdong, the chairman of BU, a smart car solution, first boasted about "far ahead" in the automobile circle, my inner feelings were actually contradictory. After all, there is no shortage of good automobile brands in China, whether it is China brand or overseas brand. As a latecomer, why does Huawei dare to boast that it is "far ahead"?

『"Far ahead" has becomeYu Chengdong’s pet phrase "

In the past, traditional media people judged the good or bad of a car. The most important thing was first of all, what was its driving experience? Everyone pays attention to the "three big pieces" of a car and its handling and comfort. With the changes in the industry, automobiles have become highly automated and intelligent, which brings the concept of "software and hardware" to the IT field and gives automobiles more definitions. Huawei’s strength at the software level cannot be underestimated.

Yu Chengdong previously said in public: "Traditional car companies in China have good vehicle (R&D) capabilities, including the overall capabilities of factory and supply chain manufacturing, which Huawei is not good at. Huawei is good at intelligence, electrification, networking, these software, algorithms, clouds and chips. The core of these capabilities is software-driven, which is exactly what car manufacturers are not good at. Therefore, we can achieve very good strong cooperation by combining with them. "

"Car Engine System of Haval H6 in 2013"

Huawei’s software development time at the automotive level is actually not short. As early as 10 years ago, in 2013, Huawei established the "Car Networking Business Department". In 2013, the best-selling Volkswagen LaVida and Haval H6 in China still stayed in the era when navigation was the "top-matching" car, which was enough to see Huawei’s advanced layout. At present, Huawei’s investment in the automotive field has reached 10 billion RMB per year (close to the R&D expenses of the second echelon head car factory in China), with more than 7,000 direct R&D personnel and over 10,000 indirect personnel.

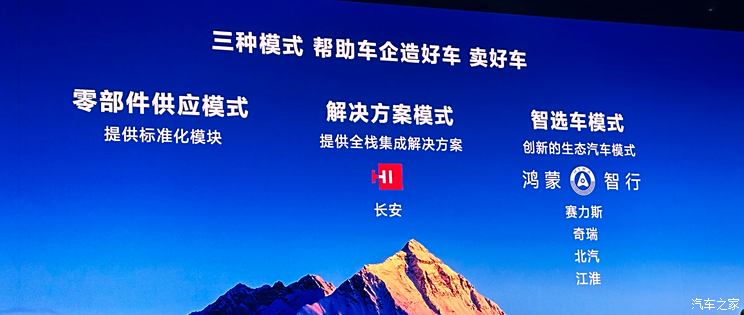

The model that can join HarmonyOS Zhixing must be the model of intelligent car selection launched by Huawei, which is the highest level of business cooperation with car companies. Yu Chengdong said: "Intelligent car selection model not only provides car manufacturers with products, components, technologies and solutions, but also provides a management system, as well as a complete set of capabilities of user experience design, product design, industrial design, brand marketing and channel retail accumulated by Huawei in the To C transformation for more than ten years, helping car companies to make cars.

Chery and Huawei signed a cooperation framework agreement as early as 2020.

The timing of HarmonyOS Zhixing’s launch is very particular, just before the launch of the first intelligent car S7 between Huawei and Chery. Chery and Huawei signed a cooperation framework agreement as early as 2020. Unlike the customers M5 and M7, the intelligent car S7, like the customer M9, has been deeply involved by Huawei from the initial stage of product development, so it has Huawei’s most advanced technology.

Huawei participated in the design and development of Zhijie S7, which matched Huawei’s latest electronic control system, vehicle system, audio system, chassis system and intelligent driving assistance system, including Huawei’s self-developed chips and software technology. At the same time, unlike Celestial, Zhijie S7 also reflected Chery’s years of experience in building cars, which can also be reflected in its brother model, Star Road Star Age ES.

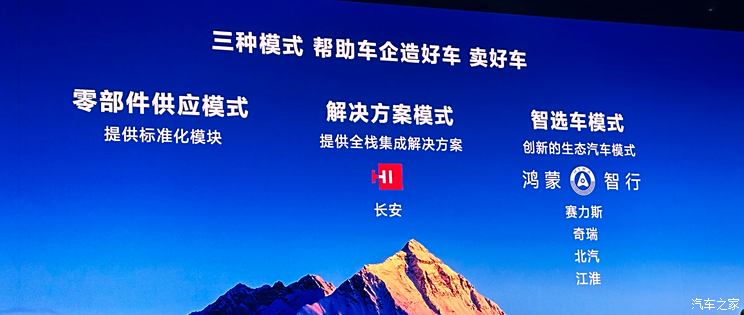

"Three Models of Huawei and Car Enterprises"

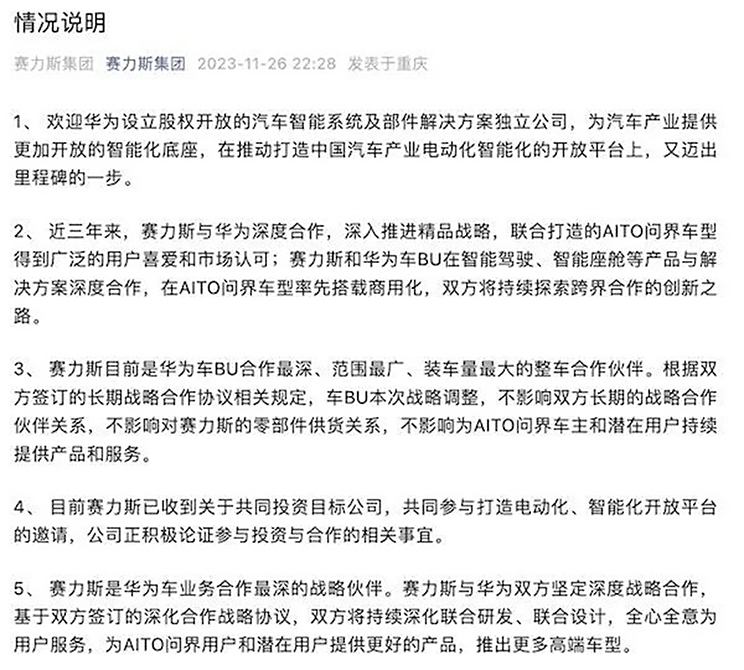

Just a few days ago, Changan and Huawei just established a new joint venture company, which will provide intelligent systems and component solutions for the intelligent car selection business, and the intelligent car selection will be an important customer of the joint venture company. The joint venture company will provide intelligent systems and component solutions for the smart car selection business, and will gradually open its equity to investors such as existing strategic partners and strategic car companies in the future.

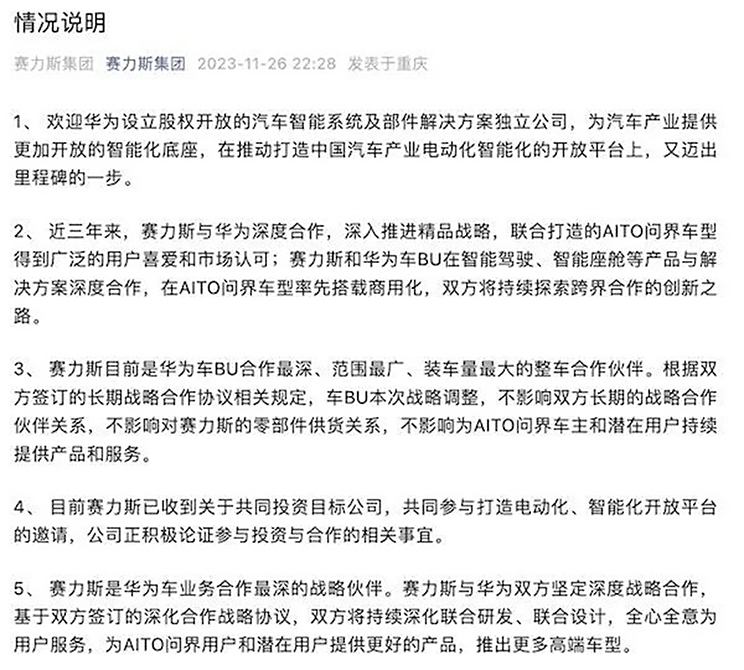

『Cyrus issued a statement on the establishment of joint venture between Huawei and Chang ‘an.』

That is to say, both Chery and Cyrus can join the equity of the joint venture company. At present, Huawei has sent an invitation to the partners of Smart Car to jointly invest in the joint venture company, and the partner status of Smart Car has not changed. This can also be confirmed from the subsequent statement issued by Cyrus. Yu Chengdong once said, "We have always believed that China needs to build an electric intelligent open platform with the participation of the automobile industry, an open platform with a’ locomotive’."

● Intelligent S7 real car experience, three advantages are impressive.

At the press conference of Zhijie S7, Yu Chengdong said that Huawei’s international design and R&D team directly participated in the design of Zhijie S7. After seeing the real car, I was deeply impressed by three places in the intellectual S7. The first is the appearance. Compared with the mediocre appearance and interior of the M5 and M7, the S7 in Zhijie has a strong sense of design. Among the many models in the store, you can recognize this car at a glance. It looks quite "low-lying", has a coupe-like outline, has a low wind resistance of 0.203Cd, and has a large and more transparent rim. At the same time, frameless doors, electric suction doors and other configurations show a sense of sophistication that has never been seen in previous models. However, for an electric car with good power, the Jiatong tires of ordinary models are slightly inferior.

"Appearance modeling is" low-lying "and dynamic"

The second is the center console of Zhijie S7. At the press conference, Yu Chengdong emphasized that Zhijie S7 bought a 100-square-meter house and gave it a 30-square terrace. After sitting in the car, you will find that the center console of Zhijie S7 is flatter and lower. As the owner of Tesla Model 3, this design makes me feel familiar and brings better vision to the driver. At the same time, the flatter center console is like a table in front of the front passengers, and this "table" also adds advanced materials, which is soft and textured to the touch. Thanks to this design, the dashboard is designed to be larger without blocking the driver’s sight. In addition to the glove box, the passenger seat has an extra upper storage space, but the space is not very deep. Coupled with the storage space in the lower part of the center console and the central armrest box, the storage in the front row is quite rich. At the same time, the embracing center console and the special-shaped steering wheel maintain the sense of movement of this car.

"The console table is low, with a good view and can form a larger plane."

"Full LCD dashboard size is not small"

"Steering wheel to increase the sense of movement"

"There is plenty of storage space in the front row, butThe upper storage space of the passenger console is not deep.』

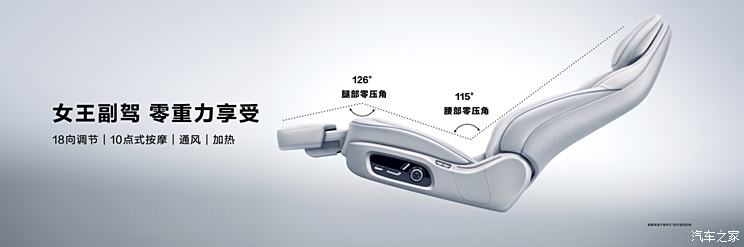

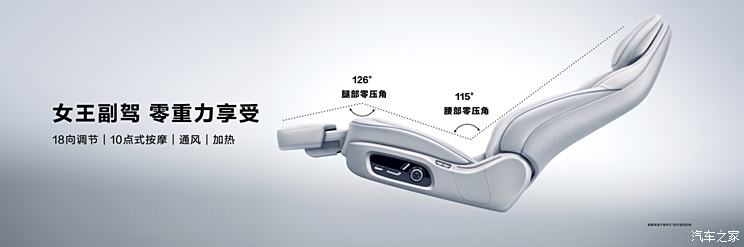

The third is the seating space. Although it is a coupe, its back row space is quite amazing, especially the leg space in the back row and the flat and spacious floor. Although compared with traditional fuel vehicles, pure electric vehicles still feel like "little Mazar", but it has been significantly improved. If the cushion is longer, it will be more perfect. At the same time, the integrated design of the canopy and the rear window brings a unique sense of transparency to the rear row. The rear door has control buttons for heating, ventilation and seat adjustment of the rear seat, and the co-pilot seat has a zero-gravity seat. It is said that the electric car is a man’s second home, and the sofa in this "home" is really good. But relatively speaking, the storage space of the trunk has a certain sacrifice, and at the same time, this car is not designed with a front trunk.

『The rear legroom is quite spacious.』

『The flat floor in the back row』

『Seat control buttons on the rear door』

『Co-pilot zero gravity seat』

『The storage space in the trunk is average.』

● Zhijie S7 has the latest "Huawei Ecology". How strong is it?

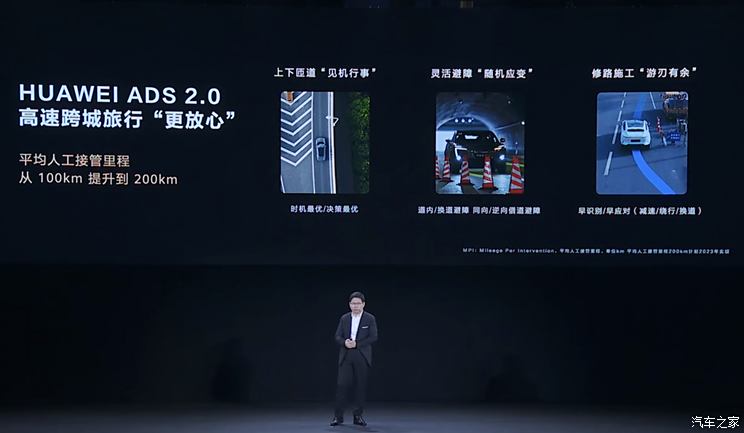

Of course, as an intellectual S7, the biggest selling point is "Huawei Ecology", and there are three main points to watch. The first is intelligent driving assistance. "Most consumers who buy the world will choose the smart driving version." In-store sales tell us that most consumers have taken a fancy to Huawei’s intelligent driver assistance system, which is also the largest part of Huawei’s R&D investment. Because this Zhijie S7 is an engineering prototype, we have no chance to experience the intelligence of Zhijie S7 in more detail, and we have not been able to drive this car on the road. However, referring to Yu Chengdong’s dialect may give us some concepts. "Intelligent driving has been the first major field invested by Huawei. At present, Huawei’s intelligent driving system is no longer dependent on high-precision maps. To achieve the highest level in the industry, beyond the ability, safety and level of Tesla FSD. "

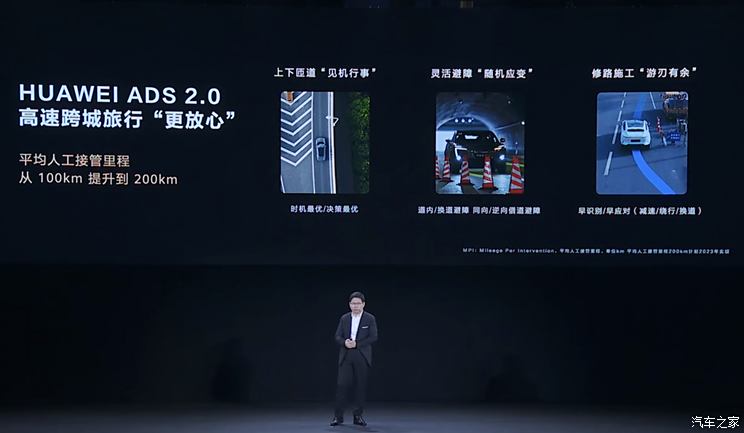

『HUAWEI ADS 2.0 high-order intelligent driving system』

More exciting videos are all on the car home video platform.

"Intelligent S7 valet automatic parking"

The latest HUAWEI ADS 2.0 advanced intelligent driving system can realize the experience of high-speed, urban and parking scenes. The system can also understand the road without high-precision maps, and the system can cover 90% of urban scenes, and it can also pass smoothly at complex intersections and mixed traffic scenes. The scene of high-speed ramp-up/down, obstacle avoidance, road construction, etc. can be improved. At the same time, parking service assistance for cross-ground and underground parking lots can be realized, and even automatic parking of mechanical parking spaces can be realized. Previously, we have already evaluated HUAWEI ADS 1.0, and you can also click here to review it.

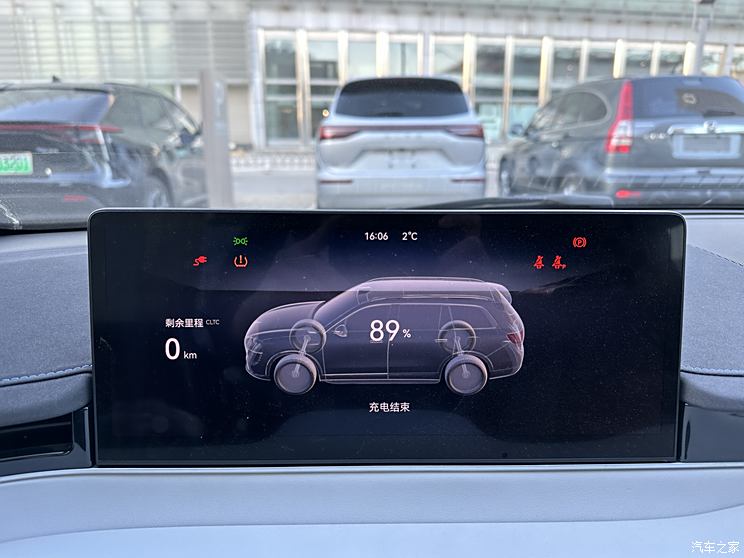

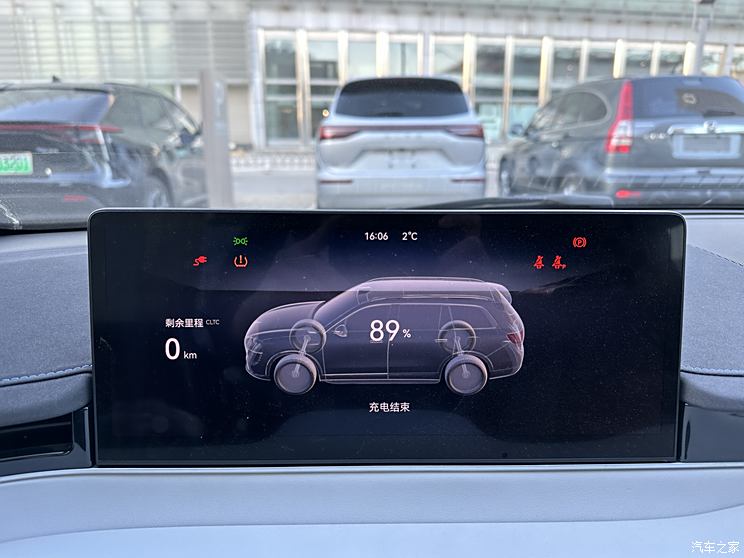

"HuaweiA new generation of DriveONE 800V high-voltage power platform』

Secondly, Zhijie S7 will use Huawei’s new generation DriveONE 800V high-voltage silicon carbide power platform and brand-new Turing intelligent chassis, which is different from Wenjie M5 and M7. Judging from the vehicle configuration provided by sales, the Max+ supercar version can achieve 855km battery life under CLTC working conditions, but it is a single motor version with a maximum power of 215 kW; Max RS four-wheel drive flagship version can achieve 0-100km/h acceleration of 3.3 seconds, and the comprehensive power of front and rear dual motors is 365 kW. In terms of charging speed, it has also achieved 200km in 5 minutes and 400km in 15 minutes. Of course, this premise is in Huawei’s overcharged network. At present, Huawei’s overcharged network still has the problem of not being fully laid. It can be seen that the strength of Huawei’s new generation DriveONE has reached almost the highest endurance level in the industry, with a leading acceleration level, and the charging speed is not much slower than refueling.

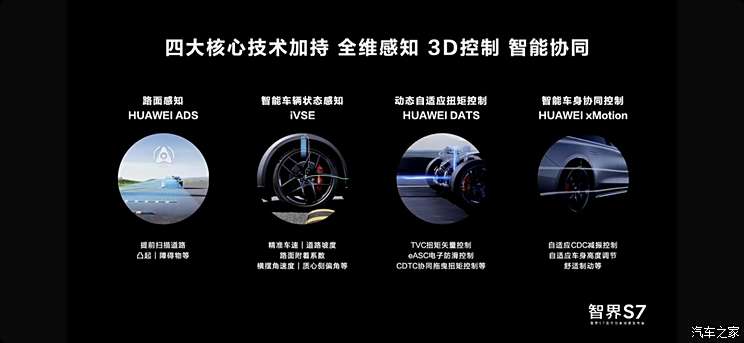

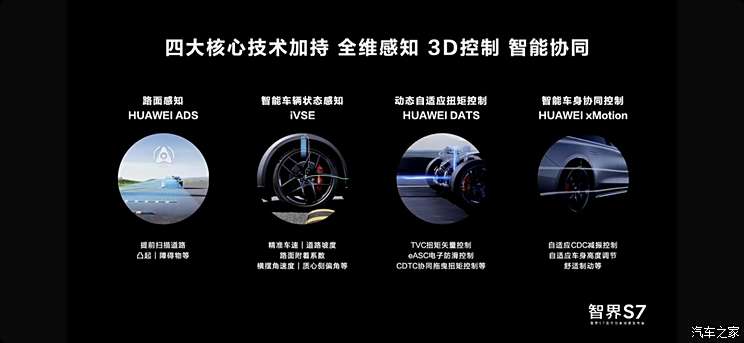

"HuaweiTuring chassis』

"HuaweiTuring chassis technology』

Turing chassis adopts front double wishbone and rear five-link front and rear independent suspension, which will have better handling and comfort experience. At the same time, the new car will also be equipped with air suspension and CDC damping adjustment. Turing chassis is also equipped with a road sensing system, which can sense the ground 150 meters in advance and adjust the comfort of suspension in advance. Maneuverability is ensured by dynamic adaptive torque control. However, sales also said that not all models will be equipped with air suspension (only the top models have it).

"HuaweiHarmonyOS 4 system in HarmonyOS』

『Voice assistant xiaoyi integrated with AI technology』

『HUAWEI SOUND car audio system』

『HUAWEI SuperCharge Charge』

"Back screen"

Thirdly, it is Huawei’s car-engine ecosystem. Intelligent S7 will be equipped with Huawei’s latest HarmonyOS 4 system in HarmonyOS, which has better interface display, front and rear three screens sharing linkage function, and voice assistant artistry integrated with AI technology. From the actual experience, there is little difference between this car system and Huawei’s mobile terminal. At the same time, it has high-definition image quality, and the system has brought more than 100 HarmonyOS applications. In addition, the new car is also equipped with HUAWEI SOUND car audio system, which can not only bring immersion sound field, but also offset 99% noise. In addition, in the front and rear rows of the vehicle, we also saw HUAWEI SuperCharge wireless charging and 66W wired charging interface. For the test drive experience of Zhijie S7, you can also click here to view it.

● Who should choose "Huawei" and "Xiaomi"?

The market in which Zhijie S7 was born can be said to be quite voluminous. In the pure electric car market of 250,000-350,000 yuan, it includes Aouita 12, BYD Han, BYD Seal, Haobo GT, Feifan F7, Extreme Krypton 001, Lantu Chasing Light, Zhiji L7, Tesla Model 3, Weilai ET5, Tucki P7 and Extreme Yue 01. In addition, there are even Volkswagen ID.7 VIZZION, Extreme Krypton 007, Xiaomi SU7 and other models ready to enter the game.

"Aouita 12 jointly built by Changan and Huawei"

"Geely and Baidu Work Together to Create Extreme Yue 01"

Although every manufacturer claims to pile up "configuration", in this era of paying attention to user experience, having configuration and experiencing well are completely two States. Especially in today’s more and more intelligent cars, it is better than the AEB incident that has been controversial for some time. We can’t just judge good or bad by having and not having, but we should be able to handle complex scenes under different working conditions and truly achieve safety protection. I also recommend you to watch a video of car home’s previous AEB test review. You can click here to review it.

"Geely’s Flyme Auto System Based on Meizu System"

Of course, in terms of intelligent ecology, every car company is constantly learning and making progress, and it cannot deny the development of a brand in the future because a car is not ideal. For example, recently, we saw Geely and Weilai enter the technology circle. Geely launched the Flyme Auto system based on Meizu system, and Weilai launched the NIO Phone mobile phone. There are also excellent suppliers of technology products like BYD. There are also today’s technology companies directly coming to the end, including new forces to build cars, as well as Huawei and Xiaomi.

In the science and technology circle, Huawei and Xiaomi are naturally the two best players. Like Apple, they have one-vote fans. When the car enters the intelligent era, the car will also join the key link of intelligent ecology. The great thing about Xiaomi is that in addition to technology products and cars, it also has a huge system of household appliances, which can realize the ecological layout of people, cars and homes. If you are a deep "rice noodle", the experience that the future will bring you will definitely be unforgettable.

"millet SU7 declaration map"

Although Xiaomi Auto has not shown its true strength, from the information that has been spoiled at present, its strength can be said to have the possibility of surpassing the intellectual S7. First of all, the two cars are very close in size, both of which are close to 5 meters. The Xiaomi car will be equipped with a battery of 101kWh, which is basically equivalent to the 97.68kWh battery of Zhijie S7, and its battery life is expected to reach 800km, which supports 800V high-voltage power technology and is also equipped with batteries from Contemporary Amperex Technology Co., Limited. The power of the front and rear double motors is 220kW and 275kW respectively, and the acceleration capacity may far exceed that of the intelligent S7 (the power of the front and rear double motors is 150kW and 215kW respectively).

| Comparison of Parameters between Zhijie S7 and Xiaomi SU7 |

| car make and model |

Zhijie S7 |

Xiaomi SU7 |

| Length/width/height (mm) |

4971/1963/1477 |

4997/1963/1440 |

| wheelbase (of a vehicle)(mm) |

2950 |

3000 |

| Total power of double-motor version (kW) |

365 |

495 |

| Total power of single motor version (kW) |

215 |

220 |

| Battery brand/battery type |

Contemporary Amperex Technology Co., Limited Ferrous lithium phosphate/Contemporary Amperex Technology Co., Limited ternary lithium |

Freddie Ferrous lithium phosphate/Contemporary Amperex Technology Co., Limited ternary lithium |

| Maximum battery capacity (kWh) |

100 |

101 |

| Maximum endurance (km) |

855(CLTC condition) |

800 (estimated) |

At the same time, as a technology company, Xiaomi’s automatic driving assistance system is also expected, including 澎湃 OS intelligent cockpit+intelligent driving assistance. However, compared with Huawei, there are no relevant models of Xiaomi yet, and the actual experience needs to be verified. Huawei’s corresponding functions have already been put on the models such as M7 and Aouita 11, and it really has a good experience. At present, for consumers, they will be more concerned about the price. Zhijie S7 announced the price first, and Xiaomi will have more flexible pricing opportunities. Compared with Zhijie S7, which is a joint cooperation between the two companies, Xiaomi, as an independent car manufacturer, may have a more flexible advantage in pricing. After all, Xiaomi is also a company that is good at price wars.

However, Zhijie S7 comes from Chery, a mature vehicle manufacturer, and Xiaomi, as the first time to build a car, the first model will be more or less immature, which may affect the product experience of subsequent users. Cars are different from mobile phone products. A "big" product needs the accumulation of brand reputation, even though Xiaomi was a big-name enterprise before. However, the Xiaomi car we know may no longer be the millet that focuses on cost performance. Whether there will really be a large number of sticky users is still unknown.

Write at the end.

"In the future, our store will shift from dealer mode to direct mode. At present, there are Huawei staff in our store." HarmonyOS Zhixing sales staff said. In the future, HarmonyOS Smart Bank will be directly priced by Huawei, and the price will be more transparent before and after sale, which is undoubtedly a good thing for consumers.

In the future, after all the different models of the four brands join HarmonyOS Zhixing, it will be a huge family system with its own characteristics. It is reported that BAIC’s HarmonyOS Zhixing model will launch a C-class pure electric car or an off-road SUV in 2024, and Jianghuai’s HarmonyOS Zhixing model will launch a million-class MPV in 2024, while FAW’s brands will also join HarmonyOS Zhixing, but it is only a network transmission and has not been officially confirmed. After that, it will form a situation that car companies will focus on hardware and Huawei will focus on ecology, making products more competitive. At the same time, Huawei will also enter the market from R&D, production, sales and after-sales to help products expand sales. At present, in the new energy vehicle market, the strategy of deep bundling cooperation will be a win-win situation. However, when the products sell well, how to distribute the revenue may become a new problem.

"The scheduled number of intelligent S7 exceeded 20,000 units"

As the first model of HarmonyOS Zhixing brand and a pure electric vehicle, it remains to be seen whether Zhijie S7 can win the market. Finally, sales also revealed to us the real market situation at present. He said that there were more consumers who paid attention to the intellectual S7 in the early stage, but recently it declined. There are many consumers on weekends, but there are almost no consumers at ordinary times. On the working afternoon when we arrive at the store, few consumers arrive at the store. However, the official said that at present, the scheduled quantity of Zhijie S7 has reached 20,000 units, but this is not necessarily the final sales result. You can also pay attention to the specific monthly sales data in the future. (Text/car home Qin Chao)