Pan Gongsheng, Governor of the Central Bank: China’s financial system is generally stable and orderly to resolve financial risks in key areas

CCTV News:Preventing and resolving financial risks, especially preventing systemic financial risks, is the fundamental task of financial work and the eternal theme of financial work. At present, how healthy is China’s financial system? What new progress has been made in risk mitigation in key areas? This reporter interviewed Pan Gongsheng, Party Secretary and President of the People’s Bank of China.

Resolve financial risks in key areas in an orderly manner.

Pan Gongsheng, Secretary of the Party Committee of China People’s Bank:At present, China’s financial system is generally sound. The People’s Bank of China will conscientiously implement the deployment of the Third Plenary Session of the 20th CPC Central Committee and resolutely hold the bottom line that systemic financial risks will not occur.

How to keep the bottom line? Pan Gongsheng introduced,At the macro level, we should grasp the dynamic balance between economic growth, economic structure adjustment and financial risk prevention.At the same time, alsoEffectively improve the effectiveness of financial supervision, strengthen supervision coordination, form a joint force of supervision, and bring all kinds of financial activities into supervision according to law.

Pan Gongsheng also highlighted the latest situation of orderly risk resolution in three key areas: local government debt, real estate and small and medium-sized banks.

Pan Gongsheng, Secretary of the Party Committee of China People’s Bank:ResolvingFinancing platform debt riskAt present, important progress has been made, the number of financing platforms and the level of existing debt have been declining, most of the debts due to financing platforms have been succeeded, reorganized and replaced, and the financing cost burden has dropped significantly compared with before. existFinancial support for real estate riskIn terms of solution, we made comprehensive measures from both sides of supply and demand, lowered the down payment ratio of mortgage loans and mortgage interest rates for many times, set up affordable housing refinancing to support the acquisition of existing commercial housing, and accelerated the construction of a new model of real estate development. ResolvingRisk of small and medium-sized financial institutionsOn the other hand, the number of high-risk small and medium-sized banks has dropped by nearly half compared with the peak.

Pan Gongsheng also introduced that the People’s Bank of China will accelerate the legislation related to financial stability, promote the construction of financial stability guarantee system, strengthen the guarantee of risk disposal resources, effectively guarantee financial security and effectively prevent systemic financial risks.

Do a good job in the "five big articles" of finance

The Third Plenary Session of the 20th CPC Central Committee put forward that "technology and finance, green finance, inclusive finance, pension finance and digital finance should be actively developed, and quality financial services for major strategies, key areas and weak links should be strengthened."

In this regard, Pan Gongsheng said that doing a good job in the "five major articles" of finance is an important focus for the high-quality development of the financial services real economy.

Pan Gongsheng said that in recent years, with the increasing financial support, the average annual growth rate of China’s inclusive small and micro loans, green loans, medium and long-term loans for high-tech manufacturing industries and loans for small and medium-sized science and technology enterprises in the past five years has been around 20% ~ 30%, which is much higher than the average growth rate of various loans.

Pan Gongsheng, Secretary of the Party Committee of China People’s Bank:The availability of financing has improved significantly.Financing cost is at a historical low.. At the same time, the rapid development of online finance and mobile finance in China has played an important role in improving transaction efficiency, reducing transaction costs and enhancing the inclusiveness of finance, and has become one of the highlights of China’s financial development.

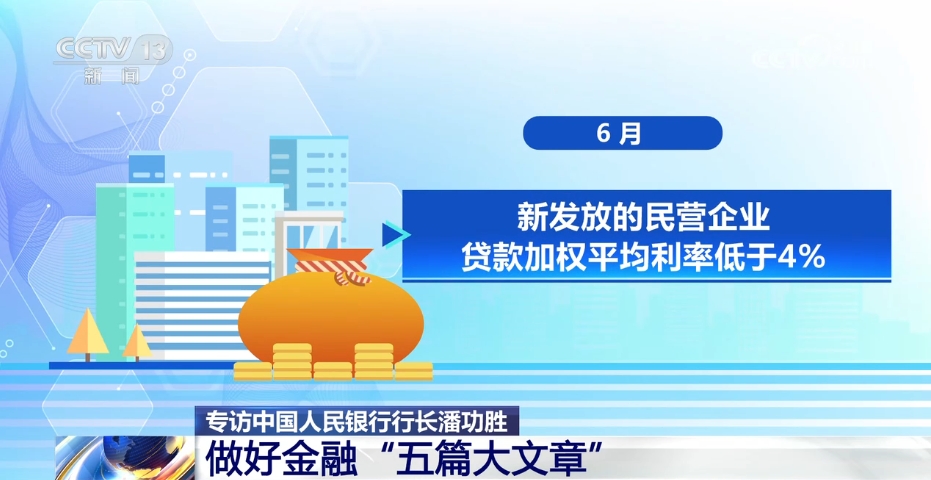

The data shows that at present, there are more than 60 million micro-credit households in China, covering about one-third of the business entities; The loan rate of small and medium-sized science and technology enterprises is close to 50%. In June, the weighted average interest rate of new private enterprise loans was less than 4%.

Pan Gongsheng said that in the next step, the People’s Bank of China will strengthen cooperation with the management departments of industries such as industry, information technology and environmental protection, further enhance the strength, sustainability and professionalism of financial support, strengthen the top-level design of policies, strengthen positive incentives, enhance the service capacity of financial institutions, broaden financing channels, and guide financial institutions to do the "five major articles" in finance.

Pan Gongsheng, Secretary of the Party Committee of China People’s Bank:The People’s Bank of China will focus on major national science and technology projects, small and medium-sized science and technology enterprises and other key areas and weak links, give full play to the role of scientific and technological innovation and technological transformation refinancing, work with relevant departments to cultivate a financial market ecology that supports scientific and technological innovation, improve the mechanism of "fundraising, investment, management and withdrawal" of venture capital, guide financial capital to invest in early, small, long-term and hard technology, meet the financing needs of scientific and technological enterprises at different life cycle stages, and continuously improve the ability and intensity of financial support for scientific and technological innovation.

Promote high-level financial opening from five aspects

The Third Plenary Session of the 20th CPC Central Committee proposed to promote a high level of financial openness, steadily and prudently promote the internationalization of RMB, and develop the offshore RMB market.

Financial openness is an inevitable requirement for building a financial power. How will the People’s Bank of China implement it?

Pan Gongsheng introduced that the People’s Bank of China will adhere to the orientation of marketization, rule of law and internationalization, enhance the transparency, stability and predictability of the financial opening policy, continue to promote high-level financial opening, and focus on five aspects.

Pan Gongsheng, Secretary of the Party Committee of China People’s Bank:One isDeepen the institutional opening of the financial sector.Promote the high-level opening of financial services and financial markets in an orderly manner. The second isSteady and prudentSolidly promote the internationalization of RMB. We will continue to improve the cross-border RMB policy on the basis of market-driven and independent choice.

At the same time, the People’s Bank of China will also support the construction of Shanghai as an international financial center, give play to the role of the International Monetary Fund as the Shanghai regional center, and enhance macroeconomic policy exchanges and coordination among countries in the Asia-Pacific region. We will continue to deepen financial cooperation between the Mainland and Hong Kong, strengthen the function of offshore RMB business hub in Hong Kong, and consolidate and enhance the status of international finance centre.

In addition, the People’s Bank of China willCreate a more friendly and inclusive business environment. Coordinate the reform of cross-border RMB and foreign exchange management, and improve the level of cross-border trade and investment and financing facilitation. Continuously improve the level of payment services.

Pan Gongsheng, Secretary of the Party Committee of China People’s Bank:Remarkable results have been achieved in facilitating the payment of foreign personnel in China. Foreign visitors to China can flexibly choose various payment methods such as bank card, cash and mobile payment. We will continue to do a good job in providing better, more efficient and convenient payment services for foreigners coming to China.

Pan Gongsheng introduced that the People’s Bank of China will continue to deeply participate in international financial governance and promote global macroeconomic and financial policy coordination by relying on platforms such as the G20, the International Monetary Fund and the Bank for International Settlements. We will implement the consensus reached at the meeting between the heads of state of China and the United States in San Francisco and take the lead in doing a good job in the financial working groups of China, the United States and China.

Pan Gongsheng, Secretary of the Party Committee of China People’s Bank:The development experience of China’s financial market shows that opening wider to the outside world is a powerful driving force and an important guarantee for high-quality financial development, and it is a key measure to enhance the ability to serve the real economy and international competitiveness. We will unswervingly do a good job in financial opening.

The latest data shows that,By the end of July, foreign investors held 4.5 trillion yuan of Chinese bonds, a record high.