The central bank announced that bank loans are the main liabilities of urban residents’ "bottom children"

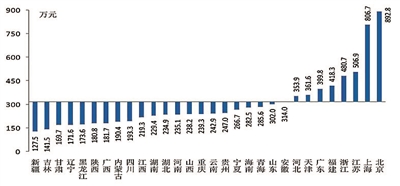

Total assets per household in each province

How many assets do urban households in China have? How much debt is there? Is the household debt risk controllable? The latest investigation and study by the investigation and statistics department of the central bank gives the answer. On April 24th, WeChat official account, the official WeChat of China Finance magazine, published the research report "Survey on the Assets and Liabilities of Urban Households in China in 2019", which was written by the research group of the Survey and Statistics Department of the People’s Bank of China.

In the middle and late October of 2019, the research group of assets and liabilities of urban households of the Survey and Statistics Department of the People’s Bank of China conducted an assets and liabilities survey on more than 30,000 urban households in 30 provinces (autonomous regions and municipalities directly under the Central Government). This is one of the most complete and detailed surveys on the assets and liabilities of urban residents in China.

According to the report, the three provinces (autonomous regions and municipalities directly under the Central Government) with the highest household assets are Beijing, Shanghai and Jiangsu, among which the average household assets of Beijing residents are 8.928 million yuan.

Family assets are mainly real estate.

Every household has 1.5 suites.

According to the survey data, the average total assets of urban households is 3.179 million yuan, and the median is 1.63 million yuan. The difference between the mean and the median is 1.549 million yuan.

After deducting the assets from the liabilities, the net assets obtained can more truly reflect the wealth level of the households. According to the survey data, the average net worth of urban households in China is 2.89 million yuan. The median net worth of a family is 1.41 million yuan, which is 1.48 million yuan lower than the average.

In terms of economic regions, the eastern region is significantly higher than other regions. The average total assets of households in the eastern region are 4.61 million yuan, which are 1.975 million yuan, 2.534 million yuan and 2.96 million yuan higher than those in the central, western and northeastern regions respectively.

The survey shows that the household assets of urban residents in China are mainly physical assets, with an average of 2.53 million yuan, accounting for 80% of the total household assets.

Of the physical assets, 74.2% are housing assets, and the average household housing assets are 1.878 million yuan. The proportion of residents’ housing assets to total household assets is 59.1%.

The survey shows that the housing ownership rate of urban households in China is 96.0%, the proportion of households with one house is 58.4%, the proportion of households with two houses is 31.0%, the proportion of households with three or more houses is 10.5%, and the average household owns 1.5 houses. The overall housing ownership rate of American households is 63.7%, which is 32.3 percentage points lower than that of China.

The more houses owned by urban households, the lower the proportion of housing assets in their household assets. The proportion of housing assets in the total assets of a family with one house is 64.3%, that of a family with two houses is 62.7%, and that of a family with three or more houses is 51.0%. This is mainly because families with multiple properties are more inclined to diversify their assets after solving their basic housing needs.

Risk-free financial assets per household are 350,000 yuan.

The total debt per household is 512,000 yuan.

According to the survey, 99.7% of the families surveyed have financial assets, with an average financial asset of 649,000 yuan, accounting for 20.4% of the total family assets. Compared with the United States, the proportion of financial assets of urban households in China is low, which is 22.1 percentage points lower than that of the United States.

The families are sorted by financial assets and physical assets from low to high. The financial assets owned by the families with the highest 10% financial assets account for 58.3% of all sample families, while the assets owned by the families with the highest 10% physical assets account for 47.1%. It can be seen that the imbalance of financial assets is more significant.

The survey shows that the holding rate of risk-free financial assets in the surveyed families is 99.6%, and the average household is 352,000 yuan; The holding rate of risk financial assets is 59.6%, and the average household is 501,000 yuan. From the survey sample as a whole, the average household holds 350,000 yuan of risk-free financial assets, accounting for 53.9% of the total financial assets, which is higher than the risk-free financial assets.

In terms of household liabilities, the survey shows that the proportion of households with liabilities is 56.5%. In terms of regions, the household debt participation rate in Northeast China is the lowest, accounting for 42.1%; 57.9% in the east and 55.7% in the middle; The highest in the western region is 60.1%.

Among the indebted families, the total debt per household is 512,000 yuan. Among them, 53.8% households have a debt balance of less than 300,000 yuan, 35.6% households have a debt balance of 300,000 to 1 million yuan, and 10.5% households have a debt balance of more than 1 million yuan. The liabilities of urban households are mainly bank loans. Among households with debts, the average bank loan is 496,000 yuan, accounting for 96.8% of the total liabilities of households.

The proportion of liabilities outside the banking system is low, only 3.2%, of which the average household liabilities of private loans and Internet financial products loans are 12,000 yuan and 0.1 million yuan respectively, accounting for 2.4% and 0.2% of the total household liabilities respectively.

From the perspective of debt use, mortgage is the basic composition of household debt. Among the indebted households, 76.8% have housing loans, and the average household housing loan balance is 389,000 yuan, accounting for 75.9% of the total household liabilities.

analyse

The household debt risk is generally controllable.

The report pointed out that the asset-liability ratio of urban households is generally stable and their solvency is generally strong.

Overall, the asset-liability ratio of urban households in China is relatively low. The survey shows that the average asset-liability ratio of urban households in China is 9.1%, which is lower than that of the United States (12.1%). Among them, the average asset-liability ratio of indebted families is 14.8%, and the median is 15.8%.

According to the report, the solvency of urban households in China is generally strong. According to the survey data, the average debt service income ratio of urban households is 18.4%, of which the mortgage debt service income ratio is 9.1%. The average debt service income ratio of indebted households is 29.5%, and the median is 26.7%.

According to the results of the investigation, the research group puts forward two problems that need to be paid attention to. First, the financial asset-liability ratio of households is relatively high, and there is a certain liquidity risk. The survey shows that the financial asset-liability ratio of urban households in China is 44.6%, among which the average financial asset-liability ratio of indebted households is 85.3% and the median is 117.3%, and the financial asset-liability ratio of more than half of households exceeds 100%. It can be seen that although the overall asset-liability ratio of residents is stable, the liquidity of assets is poor and there is a certain liquidity risk.

Second, the debt risk of some families is relatively high, mainly manifested in: some low-asset families are insolvent and the risk of default is high; Young and middle-aged groups have great debt pressure and high debt risk; There are many financial products such as wealth management, asset management and trust invested by the elderly groups, which are risky; The debt risk of just-needed mortgage families is outstanding. (Reporter Cheng Wei)