After the holiday, the property market put "explosive materials"! The two places took the lead in regulating and starting the "double cannon"

Zhongxin Jingwei Client October 11 (Dong Xiangyi) Although the property market has not been booming in the "Golden Week" this year, Xuzhou, Jiangsu Province took the lead in launching regulatory policies just after the National Day holiday, followed by Shaoxing, Zhejiang Province. The policies of the two places focus on the record price management of commercial housing, and at the same time, they also clarify the restrictions on sales, "land price restrictions, and competitive construction". According to institutional data, the number of national real estate control policies in the first nine months of this year was as high as 403 times.

According to the analysis, the policies issued by Xuzhou and Shaoxing further illustrate the orientation of not relaxing regulation. Especially in the fourth quarter, the national housing enterprises will actively promote sales and destocking, and it is also crucial to stabilize the market order at this time. It is expected that there will still be regulation and control throughout the country in the fourth quarter, focusing on the implementation of the "three stable" policy. In addition, the promotion of real estate enterprises will still have a certain driving effect on the transaction, the overall decline of the market scale can be controlled, and the house price will still be stable.

At the same time, the strict implementation of the "three red lines" will be postponed until 2023, which is also confirmed by the media as a misunderstanding and will still be fully implemented in the whole industry from 2021. As for whether it affects housing prices, in the opinion of experts, since the current policy has definitely not landed, it will have no impact on the market.

Xuzhou and Shaoxing introduced regulation after the festival.

Start the property market "double cannon"

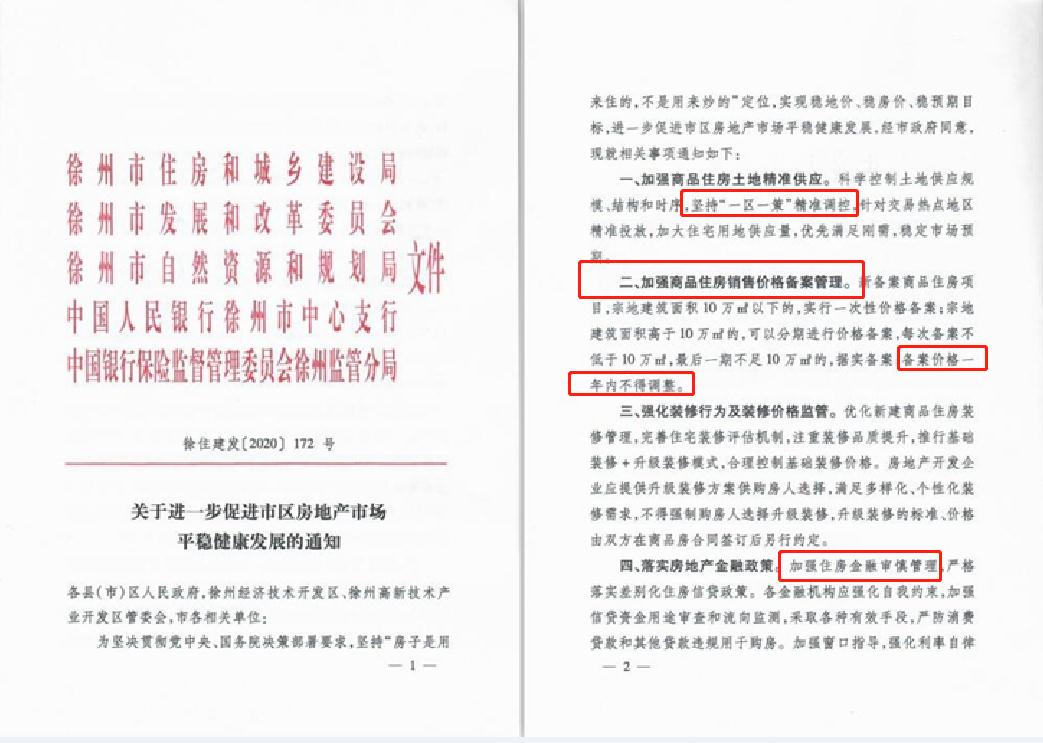

On the evening of October 9th, official website of Xuzhou Housing and Urban-Rural Development Bureau issued the Notice on Further Promoting the Healthy Development of Urban Real Estate Market, which clarified many aspects such as homestead supply, filing price management, decoration behavior and price supervision, real estate financial policy, commercial housing sales restriction, housing security and so on.

The notice is clear, and the management of the sales price of commercial housing should be strengthened. Newly-filed commercial residential projects with a parcel construction area of less than 100,000 square meters shall be filed at a one-time price; If the parcel construction area is higher than 100,000 square meters, the price can be put on record by stages, each time the record is not less than 100,000 square meters, and the last period is less than 100,000 square meters, so the record can be made according to the facts; The filing price shall not be adjusted within one year.

Source: Xuzhou Housing and Construction Bureau website

Xuzhou also stipulates that all financial institutions should strengthen the examination of the use of credit funds and the detection of the flow direction, and take various effective measures to prevent consumer loans and other loans from being used for buying houses in violation of regulations.

Xuzhou’s policy of "continuing to adhere to the policy of restricting commercial housing transactions" is not new. According to the Notice on Improving the Opinions on the Stable and Healthy Development of the Urban Real Estate Market in Xuzhou in June 2018, the sales restriction policy had been implemented at that time.

Yan Yuejin, research director of the think tank center of Yiju Research Institute, told Zhongxin Jingwei that even if the policy content is reiterated, it will continue to release the signal of policy tightening, at least similar to the constraint of six-year sales, and it can also regulate housing transactions and prevent all kinds of housing speculation. It also further magnifies the effect of the sales restriction policy.

According to the housing price data of 70 cities released by the National Bureau of Statistics in August, the sales price of new commercial housing in Xuzhou increased by 0.8% month-on-month and 11.6% year-on-year, second only to Yinchuan, Tangshan and Xining. The sales price of second-hand houses increased by 0.8% month-on-month and 7.3% year-on-year.

According to the data of Xuzhou Yibaifang, in the first three quarters of this year, the total land transaction income in Xuzhou reached 37.28 billion yuan, up 73% year-on-year, ranking 29th in the country. Quarterly, in July, August and September alone, the total amount of land transactions in Xuzhou was close to 12.5 billion yuan.

"The introduction of this policy in Xuzhou further illustrates the orientation of housing prices and expected stability." In Yan Yuejin’s view, Xuzhou’s latest new commodity housing price index rose fourth year-on-year in the country, which belongs to a city with overheated housing prices, so the policy was introduced in line with expectations.

On the same day, Shaoxing, a prefecture-level city in Zhejiang Province, followed Xuzhou and became the second city to be upgraded and regulated after the National Day holiday. According to data from the Central Plains Real Estate Research Center, Shaoxing is the 27th city in China to tighten control policies.

The website of Shaoxing Housing and Construction Bureau issued the Notice on Further Promoting the Smooth Operation of the Real Estate Market, emphasizing the strict implementation of the policy of "limiting land prices and competing for construction", the strict implementation of the "double filing" system, the strict management of sales by stages, the strict regulation of market order and the strict implementation of the main responsibility.

Source: website of Shaoxing Housing and Construction Bureau

The most important policy is to strictly implement the "double filing" system. The price filing of newly opened projects must comprehensively consider other similar housing prices or "land price+cost" and other factors in the same region, and the price filing of additional projects shall not be higher than the price of commercial housing for the first time.

Some analysts believe that this provision means that the developer’s autonomy is compressed, and the decision-making power of filing price tends to be regulated by the government. For developers, the filing price will be more scientific and reasonable, and will be subject to stricter supervision, and the filing price will not fluctuate greatly; For property buyers, the price of the real estate on sale will also be effectively controlled, and there is no need to worry about the ups and downs of housing prices.

In addition, for those who have obtained the pre-sale permit or filed the sale of existing homes, all the houses to be sold and the price of each house shall be disclosed at one time within ten days, and shall not be sold at a price higher than the declared price. In addition, increase land supply and implement differentiated land supply. Strictly implement the policy of "limiting land price and competing for construction" and strictly control premium rate and floor land price.

Yan Yuejin pointed out that from the content of Shaoxing’s property market policy, references to similar restrictions on purchases and loans are reduced, but more are aimed at land prices and housing prices. This also shows that in the current special period, we are still encouraging housing transactions, but we should guard against the speculation of land prices and housing prices.

However, institutional data show that there is no sign of rising house prices in Shaoxing recently. According to the data of Fangtianxia, the average reference price of second-hand houses in Shaoxing in September was 9436 yuan/flat, down 9.29% from August and 21.65% from the same period last year.

Photo by Xin Jingwei in the data map

The influence of policies in the two places is limited.

The national real estate regulation reached 403 times.

"These policies are all lively, not fundamental, and credit has not been fully tightened." Zhang Dawei, chief analyst of Zhongyuan Real Estate, told Zhongxin Jingwei reporter, "Looking at the contents of the regulation policies of these two cities separately, they are close to those of most cities, and the actual regulation policies are not strong, mainly due to the tightening of the filing price adjustment, which is expected to have a certain impact on the market. However, the impact is limited. "

Yan Yuejin said that after the "Eleventh" holiday, including the introduction of policies in Xuzhou and Shaoxing, further explained the orientation of not relaxing regulation. Especially in the fourth quarter, the national housing enterprises will actively promote sales and destocking, and it is also crucial to stabilize the market order at this time.

At the same time, after the festival, it was also reported that the strict implementation of the "three red lines" will be postponed until 2023. According to shanghai securities news, the news is suspected of being misread, and the "three red lines" policy has not been extended, and will still be fully implemented in the whole industry from 2021.

According to media reports, "three red lines" means that the asset-liability ratio of real estate enterprises after excluding advance payments shall not be greater than 70%; The net debt ratio of housing enterprises shall not be greater than 100%; The "cash short debt ratio" of housing enterprises is less than 1.

With the gradual tightening of the financing end of real estate enterprises, the probability of developers increasing discounts and promotions in order to reduce debts is greatly increased. As for whether it directly or indirectly affects housing prices, in the opinion of experts, it is certain that the policy has not landed now, so it has no impact on the market. It is not too late to see the impact when the policy is implemented in the future.

In the third quarter of 2020, the central government held several meetings to emphasize that the positioning of "housing and not speculating" remained unchanged, and regulatory measures were deployed from various aspects. Since July, many cities have tightened their control policies, such as Hangzhou, Ningbo, Shenzhen and Chengdu, to stabilize market expectations. From the perspective of regulatory content, the policies introduced by various localities are mainly manifested in restricting purchases, upgrading loans, increasing the number of years of restricted sales, increasing the number of years of exemption from value-added tax, strengthening the management and control of the land market, strengthening market supervision, and clarifying that high-level talents and families without houses have priority in buying houses, so as to ensure just-needed and curb real estate speculation.

According to the statistics of the Central Plains Real Estate Research Center, the total number of real estate regulation and control in the country in September this year was 35 times. From July to September alone, more than 27 cities issued more than 30 regulation and tightening policies; From January to September, the national real estate regulation and control policies totaled 403 times.

Zhang Dawei believes that although the tightening of regulation policies in August and September is not strong, it still represents the trend of real estate regulation and control, that is, one city, one policy, no speculation in housing, and maintaining the stability of the real estate market. As long as it rises too fast, it will inevitably lead to regulation and upgrading.

The latest report "Summary and Trend Outlook of China Real Estate Market in the Third Quarter of 2020" released by the Central Finger Research Institute points out that looking forward to the fourth quarter, some cities with strong expectations of rising house prices and land prices will further upgrade their property market policies to stabilize their expectations, but with the gradual emergence of policy effects, the space for policy tightening has been significantly reduced. Some cities will further increase the efforts to attract talents and relax the restrictions on settlement in terms of increasing housing subsidies and strengthening housing security, which will further promote the development of the real estate market.

Golden week property market eclipsed.

How to get the house price in the fourth quarter

Judging from the statistics released by many institutions, the National Day holiday just passed did not give the property market too many opportunities for performance. The performance of "Silver Ten" was light, and the new and second-hand housing markets showed a scene of "uneven heat and cold". According to the analysis, with the increase of residents’ demand for tourism, buyers pay more attention to travel during the long holiday and pay less attention to the property market. In the past three years, the so-called National Day property market Golden Week has faded.

According to the monitoring data of Zhuge Housing Search Data Research Center, the sales area of new houses in 10 key cities (Beijing, Shenzhen, Wuhan, Suzhou, Dalian, Fuzhou, Qingdao, Dongguan, Wenzhou and Tai ‘an) was 728,600 ㎡ during the two holidays, a slight increase of 1.6% compared with last year’s National Day Week. On the whole, the sales volume of this year’s holiday is basically the same as that of last year. However, due to the fact that this year’s holiday is one day longer than that of previous years, the average daily sales area of the 10 key cities in 2020 is 91,100 ㎡, down 11.1% year-on-year. The average daily sales area is the lowest value of National Day Week since 2015.

Source: Zhuge looking for a house

In the second-hand housing market, the data released by RealData showed that among the 18 cities monitored during the Golden Week, the average daily transaction volume of second-hand housing increased by 50% compared with the same period of last year, and the average transaction price of second-hand housing increased by 12% year-on-year.

Zhang Dawei believes that the impact of the epidemic on the real estate market has passed, and the subsequent market will continue to heat up. However, the frequent occurrence of regulatory policies has kept the increase at a "warm" level.

According to the report of the Central Finger Research Institute, in the fourth quarter, the national real estate market will show a situation that "the market scale will be slightly adjusted, the enthusiasm for new construction will slow down, and the investment growth rate will remain at a high level". With the rational return of demand under the tightening of regulation and control, the market scale will return to the adjustment channel under the cyclical action, but the active promotion strategy adopted by real estate enterprises will still have a certain driving effect on the transaction, and the overall decline of the market scale can be controlled; The overall operation of house prices will remain stable, and the increase of improved products and the emergence of the advantages of first-and second-line products will drive the average selling price to continue to rise slightly. (Zhongxin Jingwei APP)