Global news: market digests inflation data, US stocks rise and fall, humanoid robots welcome industry catalysis again.

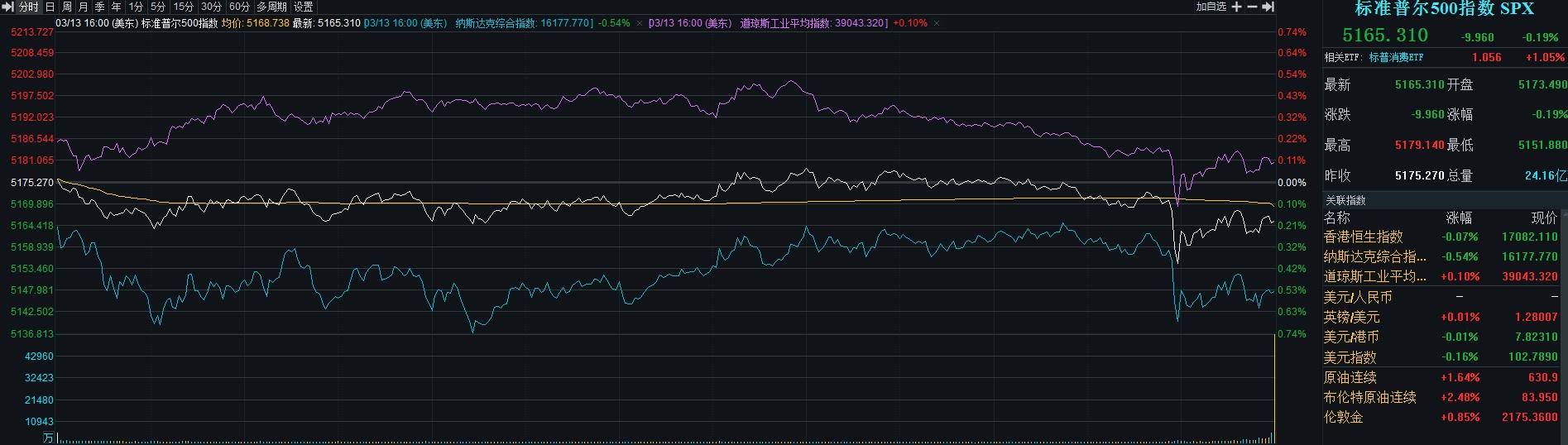

On Wednesday, Eastern Time, US chip stocks experienced a one-day rebound tour, which weakened in an all-round way overnight, and the market was also dragged down. The three major indexes were mixed. In addition, after the release of heavy inflation data, the market also lacked catalysts, and the overall performance was relatively dull.

At the close, the Dow Jones index rose 0.10% to 39,043.32 points; The S&P 500 index fell 0.19% to 5,165.31 points; The Nasdaq index fell 0.54% to 16,177.77 points.

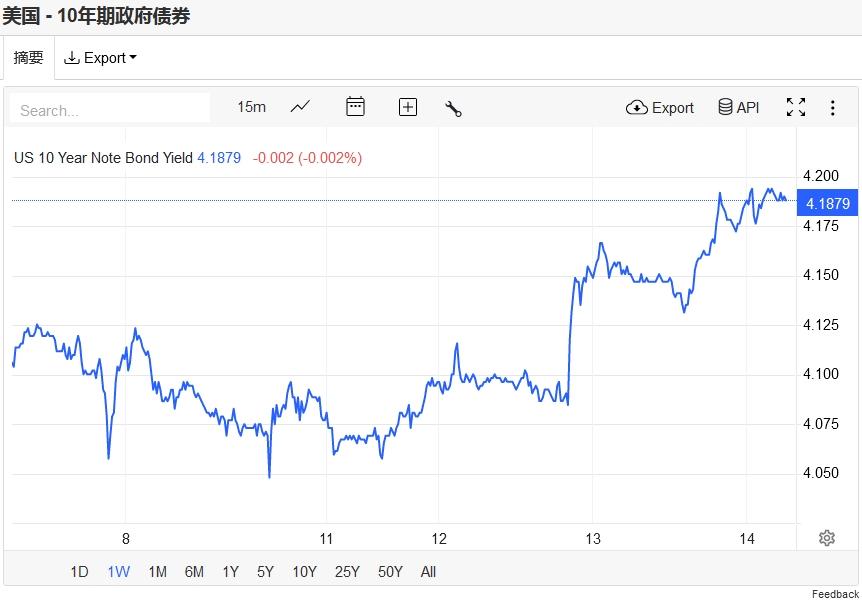

The yield of US bonds has rebounded, with the benchmark 10-year US bond yield closing at 4.1879% and the 2-year US bond yield, which is most sensitive to the Fed’s policy interest rate, closing at 4.6324%.

It may take some time for the market to digest the inflation data, because the last interest rate meeting in the first quarter will be held next week. At this meeting, the bitmap and economic outlook will be announced, when investors will have a clearer expectation for the prospect of interest rate cuts. Before that, if there is no heavy news, US stocks may be more inclined to defensive trading strategies.

Some analysts said that although the latest CPI data is a relief, people are still cautious about the basic data. In the short term, the macro narrative around the Fed will be the primary and central issue.

Let’s pay attention to the progress of the US presidential election again. According to Xinhua News Agency, according to calculations and reports from many mainstream media in the United States, former President Trump locked in the Republican presidential nomination for the 2024 US presidential election on the 12 th. That is to say, if there is no accident, Biden and Trump will fight for the second time in the presidential election, but the market has not obviously responded to this at present, and the policies pursued by the two are worthy of attention.

In terms of enterprises and industries, it is not as dull as the broader market. Tesla, in particular, has been under the headwind so far this year, and was once again slashed by two investment banks overnight. UBS maintained Tesla’s neutral rating and lowered its target price from $250 to $165. Wells Fargo lowered Tesla’s target price from $200 to $120. Tesla fell more than 4% overnight to $169.5, and there was still 30% room for decline from Wells Fargo’s target price.

Colin Langan, an analyst at Wells Fargo, reported that the growth of the electric car manufacturer in the core market has slowed down. He downgraded Tesla’s rating to the equivalent of selling. It is expected that Tesla’s sales will be flat this year and will decline in 2025. Langan writes that Elon Musk’s company is a "growth company without growth". He pointed out that in the second half of 2023, sales only increased by 3% compared with the first half, while prices fell by 5%. Analysts have become more and more cautious about Tesla, and the bullish rating ratio has dropped to the lowest since April 2021.

In the future, see how Musk will fight back.

In terms of AI, Figure, a robot startup company blessed by Amazon and NVIDIA, has released its first robot demo blessed by OpenAI. Although only a neural network is used, it can be used to hand apples to humans, put black plastic bags into frames, and put cups and plates on the drain rack in order to obey human orders. The video shows that the whole operation of the robot is very smooth.

In addition, Cerebras Systems, a California semiconductor company, released the third-generation wafer-level AI acceleration chip "WSE-3", whose specifications and parameters are even crazier, and its performance has doubled under the premise of constant power consumption and price. It can train the next generation AI model which is ten times as large as GPT-4 and Gemini, and can store 24 trillion parameters in a single logical memory space without partition or reconstruction.

However, it should be noted that the EU passed the world’s first heavy artificial intelligence supervision bill, which is expected to take effect in May.

[Hot stocks]

Most large technology stocks fell, with Apple down 1.21%, Microsoft down 0.04%, NVIDIA down 1.12%, Google up 0.93%, Amazon up 0.66%, Meta down 0.84% and Tesla down 4.54%.

In terms of Chinese stocks, Nasdaq China Jinlong Index rose by 1.04%, Alibaba rose by 0.43%, JD.COM rose by 2.34%, Pinduoduo rose by 3.55%, Weilai Automobile fell by 4.36%, Xpeng Motors fell by 3.10%, LI fell by 3.30%, Blilly fell by 1.42%, Baidu rose by 2.49% and Netease rose by 1.94%.

[global index]

In European stock markets, the FTSE 100 index rose slightly by 0.31% to 7772 points. The French CAC40 index rose slightly by 0.62% to 8138 points. Germany DAX index fell slightly by 0.02% to 17,961 points.

In Asian stock markets, the Hang Seng Index fell slightly by 0.07% to 17,082 points. The index of state-owned enterprises fell slightly by 0.29% to 5932 points.

[foreign exchange commodities]

The main contract of Brent crude oil closed at $83.95 per barrel, up 2.48%; The main contract of crude oil in the previous period closed at 630.90 yuan per barrel overnight, up 1.64%.

Overnight, the Shanghai gold main contract closed up 0.76% to 508.84 yuan per gram.

[Highlights]

Yellen: US interest rates are unlikely to fall back to the pre-epidemic level. The slowdown in rent growth will push inflation down.

As to why the forecast released by the White House on Monday shows that the interest rate forecast in the next few years is significantly higher than that of a year ago, Yellen said that the relevant economic forecast of the White House reflects the current market reality, and she also refuted the concerns about stagflation, insisting that the progress in inflation has not stagnated.

Figure launches robot demo blessed by OpenAI big model.

Robot startup Figure released its first robot demo blessed by OpenAI big model. Although only a neural network is used, it can be used to hand apples to humans, put black plastic bags into frames, and put cups and plates on the drain rack in order to obey human orders. The video shows that the whole operation of the robot is very smooth.

The world’s first AI chip upgrades 4 trillion transistors and 900,000 cores.

Cerebras Systems, a California semiconductor company, released the third-generation wafer-level AI acceleration chip "WSE-3", with even crazier specifications and doubled performance under the premise of unchanged power consumption and price. WSE-3 was upgraded to TSMC’s 5nm process again, but the area was not mentioned, but it should be similar. However, the number of transistors continued to increase to an astonishing 4 trillion, the number of AI cores further increased to 900,000, the cache capacity reached 44GB, and the external matching memory capacity was 1.5TB, 12TB and 1200TB. The number of cores and cache capacity have not increased much, but the performance has achieved a leap. The peak AI computing power is as high as 125PFlops, which is 1.25 billion floating-point calculations per second, comparable to the top supercomputing. It can train the next generation AI model which is ten times as large as GPT-4 and Gemini, and can store 24 trillion parameters in a single logical memory space without partition or reconstruction. Four parallel, it can complete the adjustment of 70 billion parameters in one day, and support up to 2048 interconnections, and it can complete the training of Llama 700 billion parameters in one day.

UBS and Wells Fargo slash Tesla’s target price

On March 13th, local time, Tesla closed down 4.54% to $169.48, and its market value evaporated by about $257 overnight, with a total market value of $539.8 billion. UBS maintained Tesla’s neutral rating and lowered its target price from $250 to $165. Wells Fargo lowered Tesla’s target price from $200 to $120.

The European Parliament passed the Artificial Intelligence Act.

On March 13th, the European Parliament passed the landmark Artificial Intelligence Act with 523 votes in favor, 46 votes against and 49 abstentions. The European Parliament said that the bill aims to protect basic rights, democracy, the rule of law and environmental sustainability from the impact of high-risk artificial intelligence, while promoting innovation to "build Europe into a leader in this field". The bill will ban some artificial intelligence applications that "threaten citizens’ rights", including biometric classification systems based on sensitive features, as well as capturing facial images from the Internet or closed-circuit television videos to create a facial recognition database. Artificial intelligence that manipulates human behavior or exploits human weaknesses will also be banned.

Musk confirmed that Tesla’s German factory resumed operations.

Musk issued a document on March 13 that Tesla’s super factory in Berlin has resumed operations and thanked the employees for their support. It is reported that the Tesla German factory was blacked out for a week due to arson. The power company responsible for solving the power outage said later on Monday that the factory had been reconnected to the power grid. It is reported that the factory has about 12,500 employees.

It is reported that Samsung Electronics plans to increase the price by 15-20% with downstream manufacturers on the price negotiation of NAND flash memory.

Samsung Motor plans to renegotiate the price of NAND flash memory with major mobile, PC and server customers from this month to next month, with a target price increase of 15-20%. After more than a year of oversupply, the price of Samsung Electronics’ NAND flash memory was once flat, so it plans to negotiate with big customers to bring the price back to a reasonable level.

GPT-4.5 is suspected to be available. OpenAI official website webpage was indexed by netizens. GPT-4.5Turbo was officially released on Thursday.

Search engines such as Bing and DuckDuck Go have indexed the product pages of GPT-4.5Turbo, and netizens speculated that the official release date of GPT-4.5 Turbo might be this Thursday-the anniversary of the release of GPT-4.

[financial calendar]