Wang Xing cashed in 300 million Hong Kong dollars in LI, and the growth rate of new car delivery slowed down in August.

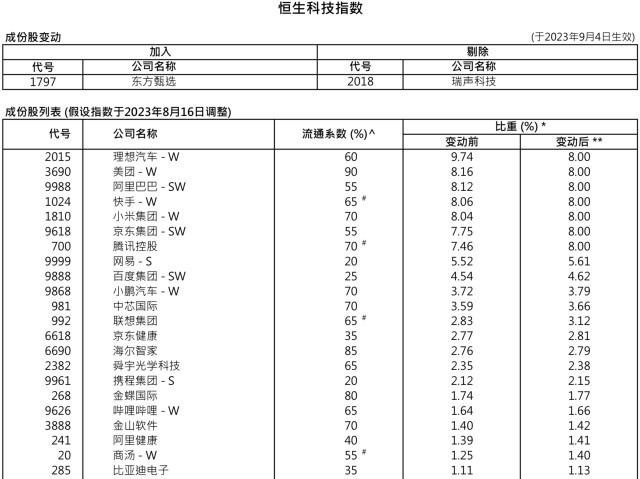

"Trams sell well, all because of the large fuel tank." Many investors are so ridiculous. Extended-range hybrid vehicles have eliminated consumers’ anxiety about the endurance of pure electric vehicles, and the share price of LI-W (02015.HK) has been hitting record highs, becoming the first component of the Hang Seng Science and Technology Index (HSTECH).

However, shortly after Ideal announced the delivery data of nearly 35,000 vehicles in August, the major shareholder Wang Xing couldn’t wait to continue to "sell and sell"; The growth rate of LI’s monthly delivery volume has slowed down significantly; In addition, in the context of the sharp rise in raw material prices, it is also facing more fierce competition in the price war of the whole vehicle. However, LI is determined to develop pure electric products that have suffered heavy bicycle losses.

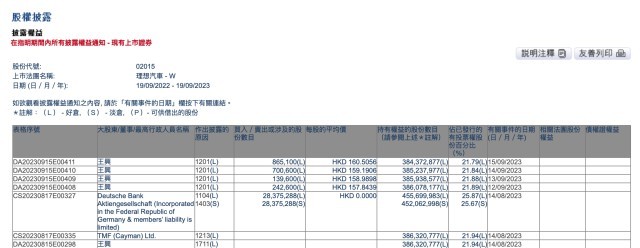

Wang Xing reduced his holdings by nearly 2 million shares.

According to information disclosed by HKEx, Wang Xing, CEO of Meituan-W (03690.HK) and non-executive director of LI, reduced his holdings of LI for four consecutive days. From September 12th to 15th, Wang Xing reduced his holdings by 1,947,900 shares, with an average price of HK$ 157.84 to HK$ 160.51, and cashed in more than HK$ 300 million.

On September 3rd, LI announced that a total of 34,914 new cars were delivered in August 2023, up 2.28% from the previous month. So far, the cumulative delivery volume of LI in 2023 reached 208,200 vehicles, a year-on-year increase of 176.1%; In July, the delivery volume of 34,134 vehicles was only 4.7% higher than that of the previous month. The company expects that the number of vehicles delivered in the third quarter will be 100,000 to 103,000, a year-on-year increase of 277.0% to 288.3%.

Lin Jiayi, general manager of Xuanjia Fund, told the First Financial Reporter that the growth of LI’s monthly sales slowed down sharply, and the chip loosening and callback were predictable from the perspective of fundamental performance prospects, the continuous deterioration of industry competition and the poor liquidity of the capital market with high interest rates. In the dominant business, the space of family scene is limited, and its short moat may not be stable. The possible expansion of pure electric business is a highly competitive market.

Huang Xili, an analyst in soochow securities, said that the delivery in August was higher than that in the previous month, and the steady supply and delivery of vehicles and the continuous growth of terminal orders formed a positive cycle. By the end of August, LI had delivered a total of 208,200 vehicles, up 176.1% year-on-year, and its annual performance was worth looking forward to. In addition, the channel network layout has been accelerated and improved, and the terminal efficiency has been continuously improved.

On August 18th, Hang Seng Index Co., Ltd. announced the results of the index review. LI’s share in the Hang Seng Science and Technology Index will be reduced from 9.74% to 8%, and its share with six leading Internet companies will be 8%.

At present, most pure tram companies are still mired in losses, and some new forces sell a car, with an average loss of tens of thousands of yuan. However, LI, which has turned losses into profits, has to make efforts in this field to "further broaden the user base and open up incremental markets."

"The company plans to launch the 5C pure electric super flagship model in the fourth quarter of 2023, the ideal MEGA. The company is confident that the car will become an explosive model of more than RMB500,000. " LI said in the semi-annual report.

"In the new stage of parallel operation of extended-range electric and high-voltage pure electricity, we will continue to improve our research and development capabilities in the fields of intelligence and electrification, optimize our products and expand our product matrix. By 2025, our product matrix is expected to include a super flagship model, five extended-range electric vehicles and five high-voltage pure electric vehicles. " The company also said: "We currently have a manufacturing base in Changzhou, China to produce extended-range vehicles, and are building a manufacturing base in Beijing to actively expand production capacity and prepare for the release of pure electric vehicles."

Lin Jiayi believes that in recent days, major car companies are also constantly cutting prices, trying to maintain market share. Under this background, LI’s growth space is facing challenges.

Huang Xili said that MEGA is expected to be officially released in December this year, exhibited in stores in January 2024, and delivered by users in February. The launch of MEGA will help LI achieve the goal of being the first luxury car brand in China in 2024.

Cui Yan, an analyst at Huaxi Securities, believes that LI’s products should be judged not only by price or body form, but also by what kind of demand the products meet, which stems from the ideal understanding of users’ needs and the extensive demand for family cars. The company has great hope to replicate the success of the extended range series in the pure electric product line to gain greater market share.

Car companies whose downstream terminal prices are decreasing are also facing the situation that the upstream raw material prices are rising sharply, which will challenge the gross profit margin: within more than three months since the end of May, major industrial products such as copper and aluminum have risen sharply in three months, and the prices of raw materials have risen in an all-round way. In September, Shanghai Aluminum once approached the 20,000 yuan/ton mark, which caused certain cost pressure on auto parts and vehicle enterprises, especially for electric vehicles, and the demand for aluminum was increasing.